Bioactive Ingredients Size

Bioactive Ingredients Market Growth Projections and Opportunities

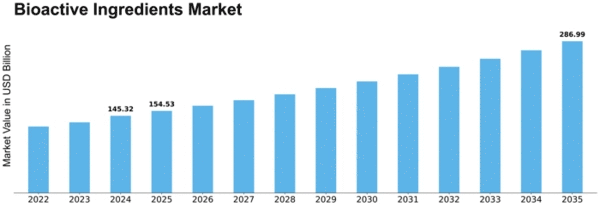

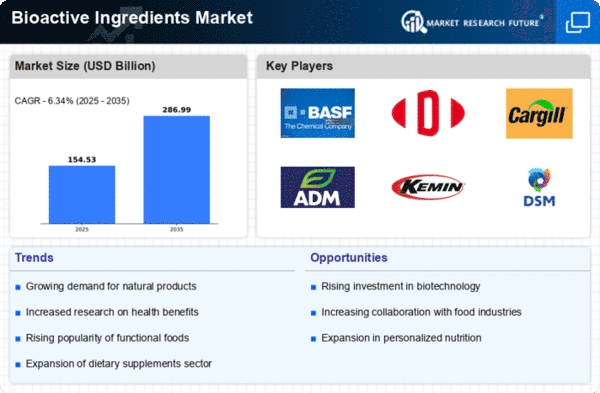

The Bioactive Ingredients market is shaped by a myriad of factors that collectively influence its growth and dynamics. One of the primary drivers is the increasing consumer awareness and demand for health and wellness products. As individuals become more conscious of their well-being, there is a rising inclination towards incorporating bioactive ingredients into their diets. These ingredients, derived from natural sources, are known for their potential health benefits and are commonly found in functional foods, dietary supplements, and nutraceuticals. The growing trend of preventive healthcare further fuels the demand for bioactive ingredients, as consumers seek products that contribute to overall health and disease prevention. By 2022–2030, the bioactive ingredients market is expected to grow at a 7.3% CAGR to reach a USD 51.73 billion.

Technological advancements and innovation play a pivotal role in the Bioactive Ingredients market. Continuous research in fields such as biotechnology and food science has led to the discovery and development of novel bioactive compounds with enhanced functionalities. This innovation not only expands the range of available bioactive ingredients but also opens up new application areas, creating opportunities for market growth. The ability to extract, isolate, and utilize bioactive compounds in various industries, including food and beverages, cosmetics, and pharmaceuticals, contributes to the market's dynamism and adaptability.

Globalization is another significant factor influencing the Bioactive Ingredients market. With the expansion of international trade, there is a growing demand for bioactive ingredients that comply with diverse regulatory standards and consumer preferences across different regions. Bioactive ingredients that can cater to the varied needs of a global market become essential for companies aiming to establish a presence on an international scale. Moreover, the exchange of knowledge and technologies between regions facilitates the development and adoption of bioactive ingredients in diverse cultural and culinary contexts.

The emphasis on sustainability and eco-friendly practices is gaining prominence in the Bioactive Ingredients market. As consumers become more environmentally conscious, there is a growing preference for products that align with sustainable principles. Bioactive ingredients, often sourced from natural and renewable resources, fit well within this framework. Companies are increasingly adopting sustainable sourcing practices and production methods to meet the demand for eco-friendly products, thereby influencing the market towards more responsible and environmentally sustainable approaches.

However, challenges persist in the Bioactive Ingredients market, particularly related to regulatory compliance and standardization. The regulatory landscape for bioactive ingredients is diverse and can vary significantly across different regions. Navigating these regulatory frameworks and ensuring compliance with safety and quality standards pose challenges for market players. Additionally, the standardization of bioactive ingredients to guarantee consistent quality and efficacy remains a complex task, impacting market growth.

Leave a Comment