Bio-Fertilizers Market Summary

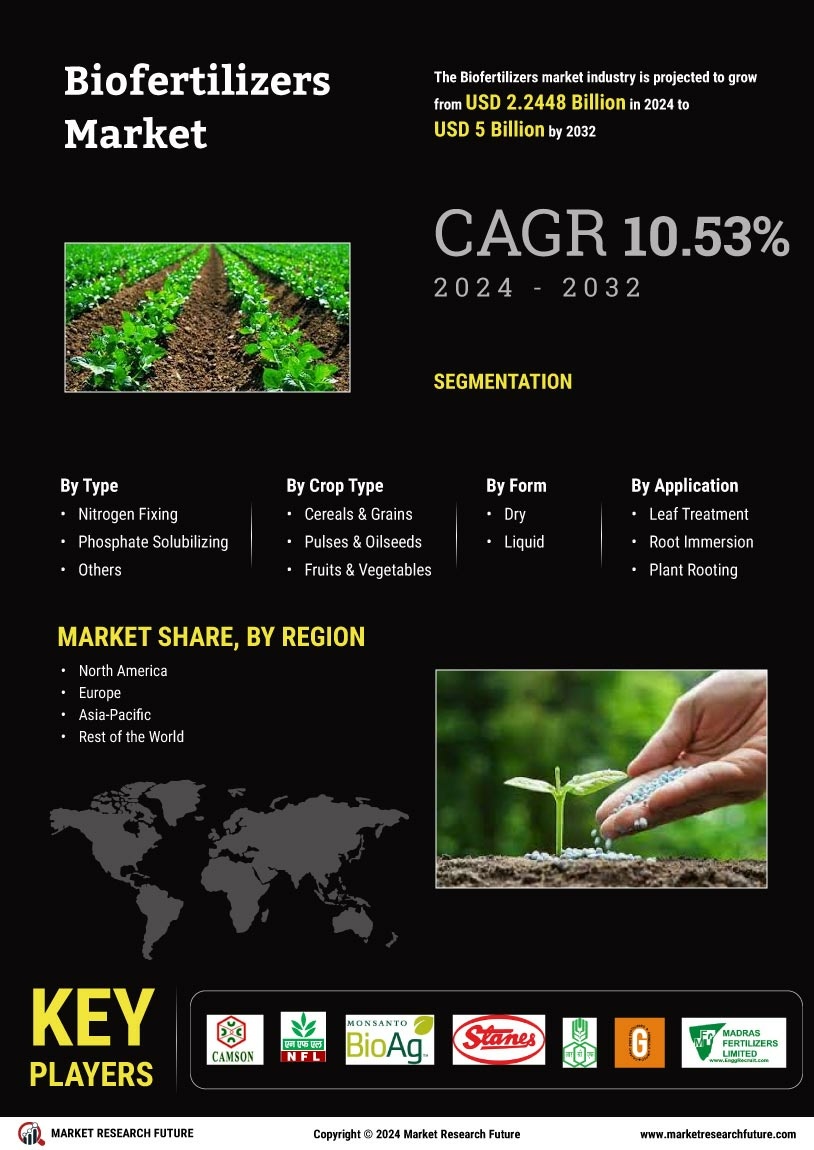

The Global Biofertilizers Market is projected to grow from 2.24 USD Billion in 2024 to 6.75 USD Billion by 2035, reflecting a robust growth trajectory.

Key Market Trends & Highlights

Biofertilizers Key Trends and Highlights

- The market is expected to expand at a compound annual growth rate of 10.55 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 6.75 USD Billion, indicating a substantial increase from the base year.

- in 2024, the market is valued at 2.24 USD Billion, highlighting the current investment in biofertilizers.

- Growing adoption of sustainable agricultural practices due to increasing environmental concerns is a major market driver.

Market Size & Forecast

| 2024 Market Size | 2.24 (USD Billion) |

| 2035 Market Size | 6.75 (USD Billion) |

| CAGR (2025-2035) | 10.53% |

Major Players

Kraft Chemical Company, AgBiome, Agroforestry Research, Valagro, Biolchim, Biotech Products, Syngenta, Arabian Agricultural Services, Raviplast, Novozymes, BioWorks, BASF, Ginkgo BioWorks, Lallemand, Nutrifield