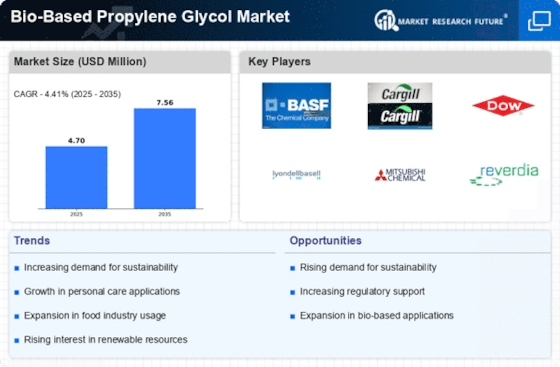

Top Industry Leaders in the Bio-Based Propylene Glycol Market

The bio-based propylene glycol (Bio-PG) market is experiencing a surge in growth, driven by a confluence of factors like rising environmental consciousness, increasing demand for sustainable ingredients, and the versatility of the product itself. This burgeoning market presents a dynamic competitive landscape, with established players and emerging contenders vying for market share. Let's delve into the key strategies, market dynamics, and recent developments shaping this exciting space.

List of Strategies Adopted:

- Innovation: Leading players are investing heavily in R&D to optimize production processes, develop new Bio-PG variants with enhanced functionalities, and explore alternative feedstocks like corn, wheat, and cassava. Cargill, for instance, recently announced a collaboration with a biotechnology company to produce Bio-PG from cellulosic biomass.

- Sustainability Partnerships: Companies are forging partnerships with feedstock suppliers, waste management firms, and research institutions to ensure a sustainable supply chain and minimize environmental impact. BASF's collaboration with a waste management company to produce Bio-PG from recycled glycerol exemplifies this trend.

- Vertical Integration: Some players are adopting vertical integration strategies, acquiring feedstock sources or downstream production facilities to gain greater control over the supply chain and improve cost efficiency. Archer Daniels Midland (ADM) is a prime example, having acquired a company specializing in corn processing to secure a reliable feedstock source for its Bio-PG production.

- Marketing and Branding: As consumer awareness of sustainability increases, companies are emphasizing the eco-friendly credentials of their Bio-PG products through targeted marketing campaigns and certifications. Dow Chemical, for instance, has launched its "Ecolibrium" brand specifically for sustainable chemicals, including Bio-PG.

Factors for Market Share:

- Production Capacity and Cost Competitiveness: Companies with large-scale production facilities and efficient processes can offer Bio-PG at competitive prices, gaining an edge in price-sensitive markets. Dow Chemical's global network of manufacturing plants and BASF's technological advancements in production are examples of competitive advantages.

- Product Portfolio Diversity: Offering a diverse range of Bio-PG variants tailored to specific applications (e.g., food grade, pharmaceutical grade) allows companies to cater to a wider customer base and capture market share in different segments. Ashland's extensive Bio-PG portfolio caters to various industries, from cosmetics to food and beverages.

- Geographic Presence and Distribution Network: Strong distribution networks and a presence in key markets like Europe and North America, where demand for Bio-PG is high, provide a significant advantage. Cargill's expansive distribution network across Europe and Asia is a case in point.

- Regulatory Landscape and Government Policies: Favorable government policies like tax incentives or subsidies for Bio-PG production can create a conducive market environment for specific players. The EU's Renewable Energy Directive, for instance, has spurred Bio-PG production in the region.

List of Key Players in the Bio-based Propylene Glycol Market

- Archer Daniels Midland Company (U.S.)

- BASF SE (Germany)

- The Dow Chemical Company (U.S.)

- DuPont Tate & Lyle Bio Products Company, LLC (UK)

- Huntsman International LLC. (U.S.)

- Cargill (U.S.)

- Oleon (Belgium),

- Ashland. (U.S).

Recent Developments:

November 2023: BASF partners with a Brazilian company to produce Bio-PG from sugarcane, aiming to reduce the carbon footprint of its product.

September 2023: Cargill launches a new Bio-PG product line with enhanced purity for use in pharmaceuticals and cosmetics.

August 2023: Archer Daniels Midland invests USD 100 million in a new Bio-PG production facility in China to tap into the growing Asian market.

July 2023: Dow Chemical announces a collaboration with a startup to develop a novel Bio-PG production technology using microbes.

June 2023: The European Union approves a new regulation that restricts the use of fossil-based propylene glycol in certain food and beverage applications, creating a further boost for Bio-PG.