Growth in Automotive Sector

The automotive sector plays a pivotal role in the Global Benzene Market Industry, as benzene-derived products are integral to manufacturing tires, plastics, and synthetic fibers. The ongoing advancements in automotive technology, particularly in electric vehicles and lightweight materials, are likely to bolster the demand for benzene. As the industry adapts to new standards and consumer preferences, the market for benzene is anticipated to flourish. By 2035, the Global Benzene Market could reach 93.9 USD Billion, reflecting the automotive sector's influence on benzene consumption and its derivatives.

Rising Demand for Petrochemicals

The Global Benzene Market Industry is experiencing a surge in demand for petrochemicals, which are essential for producing various chemicals and materials. Benzene Market serves as a fundamental building block in the synthesis of styrene, phenol, and other derivatives. As industries such as automotive, construction, and consumer goods expand, the need for these petrochemical products increases. This trend is projected to contribute significantly to the market's growth, with the Global Benzene Market expected to reach 48.9 USD Billion in 2024. The continuous evolution of technology and processes in petrochemical production further supports this demand.

Increasing Use in Pharmaceuticals

The pharmaceutical industry is increasingly relying on benzene derivatives for the production of various medications and health-related products. Benzene Market is utilized in the synthesis of active pharmaceutical ingredients, which are crucial for developing effective treatments. As global health awareness rises and the demand for innovative therapies grows, the Global Benzene Market Industry is poised for expansion. The integration of benzene in pharmaceutical applications not only enhances product efficacy but also contributes to the overall market growth, indicating a promising future for benzene in this sector.

Emerging Markets and Economic Growth

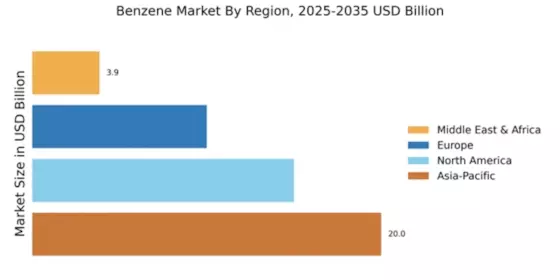

Emerging markets are becoming increasingly significant in the Global Benzene Market Industry, driven by rapid industrialization and urbanization. Countries in Asia-Pacific and Latin America are witnessing substantial economic growth, leading to heightened demand for benzene and its derivatives. This trend is expected to propel the market forward, as these regions invest in infrastructure and manufacturing capabilities. The anticipated compound annual growth rate of 6.12% from 2025 to 2035 underscores the potential of these emerging markets to shape the future landscape of the benzene industry.

Regulatory Framework and Environmental Considerations

The Global Benzene Market Industry is influenced by stringent regulatory frameworks aimed at controlling benzene emissions and ensuring environmental safety. Governments worldwide are implementing regulations to mitigate the health risks associated with benzene exposure, which may drive innovation in cleaner production methods. While these regulations present challenges, they also encourage the development of sustainable alternatives and technologies. Companies that adapt to these regulations may find new opportunities for growth, potentially leading to a more responsible and environmentally friendly benzene market.