Growing Global Demand for Craft Beer

The Global Beer Processing Market Industry experiences a notable surge in demand for craft beer, driven by consumers' increasing preference for unique flavors and artisanal production methods. This trend is particularly evident in regions such as North America and Europe, where craft breweries have proliferated. In 2024, the market is projected to reach 102.9 USD Billion, reflecting the growing inclination towards locally produced and innovative beer options. The craft beer segment not only enhances the diversity of the market but also contributes to local economies, as small breweries often source ingredients from nearby farms, thereby fostering community engagement and sustainability.

Emerging Markets and Global Expansion

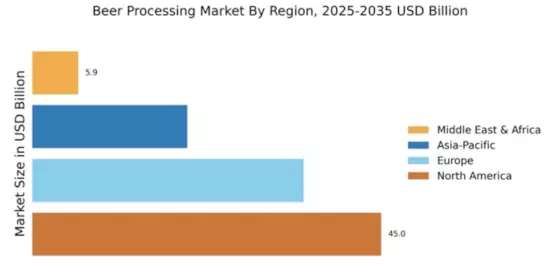

Emerging markets present significant growth opportunities for the Global Beer Processing Market Industry, as rising disposable incomes and changing lifestyles drive beer consumption. Regions such as Asia-Pacific and Latin America are witnessing an increase in beer consumption, fueled by urbanization and a burgeoning middle class. As global breweries expand their reach into these markets, they adapt their offerings to local tastes and preferences, further stimulating growth. The anticipated increase in market size from 102.9 USD Billion in 2024 to 137.4 USD Billion by 2035 underscores the potential of these emerging markets, which could significantly contribute to the overall CAGR of 2.67% from 2025 to 2035.

Sustainability Initiatives in Brewing

Sustainability has emerged as a critical driver in the Global Beer Processing Market Industry, as consumers increasingly favor brands that prioritize environmental responsibility. Breweries are adopting sustainable practices, such as water conservation, energy efficiency, and waste reduction, to minimize their ecological footprint. For example, some breweries utilize renewable energy sources and implement recycling programs to enhance their sustainability credentials. This commitment to environmental stewardship not only attracts eco-conscious consumers but also aligns with regulatory frameworks aimed at reducing carbon emissions. As sustainability becomes a core value for consumers, it is likely to influence purchasing decisions and shape the future of the market.

Technological Advancements in Brewing

Technological innovations play a pivotal role in the Global Beer Processing Market Industry, enhancing production efficiency and product quality. Modern brewing techniques, such as automated brewing systems and advanced fermentation monitoring, allow breweries to optimize their processes and reduce waste. For instance, the implementation of IoT devices in brewing facilities enables real-time data analysis, leading to improved consistency and flavor profiles. As breweries adopt these technologies, they can scale operations while maintaining high standards, which is crucial for meeting the anticipated market growth from 102.9 USD Billion in 2024 to 137.4 USD Billion by 2035.

Health Consciousness and Low-Alcohol Options

The increasing health consciousness among consumers is reshaping the Global Beer Processing Market Industry, with a growing demand for low-alcohol and non-alcoholic beer options. As individuals become more aware of their dietary choices, breweries are responding by developing products that cater to this trend. Low-calorie and gluten-free beers are gaining traction, appealing to health-focused consumers. This shift not only broadens the consumer base but also encourages traditional breweries to innovate their product lines. The market's evolution towards healthier options is likely to contribute to its projected CAGR of 2.67% from 2025 to 2035, reflecting changing consumer preferences.