Beauty Products Market Summary

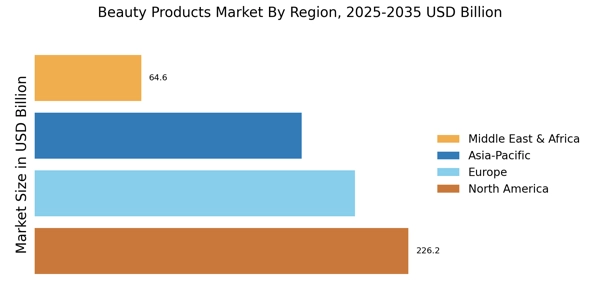

As per MRFR analysis, the Beauty Products Market was estimated at 646.13 USD Billion in 2024. The beauty products industry is projected to grow from 666.94 USD Billion in 2025 to 915.63 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.22 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Beauty Products Market is experiencing a transformative shift towards sustainability and personalization.

- The market is increasingly prioritizing sustainability, with brands adopting eco-friendly practices and materials.

- Personalized beauty solutions are gaining traction, as consumers seek products tailored to their individual needs.

- In North America, the influence of social media and beauty influencers is shaping consumer preferences and purchasing decisions.

- The rise of e-commerce platforms and the growing demand for natural ingredients are driving market growth, particularly in the Asia-Pacific region.

Market Size & Forecast

| 2024 Market Size | 646.13 (USD Billion) |

| 2035 Market Size | 915.63 (USD Billion) |

| CAGR (2025 - 2035) | 3.22% |

Major Players

L'Oreal (FR), Unilever (GB), Procter & Gamble (US), Estée Lauder (US), Coty (US), Shiseido (JP), Revlon (US), Avon (GB), Beiersdorf (DE)