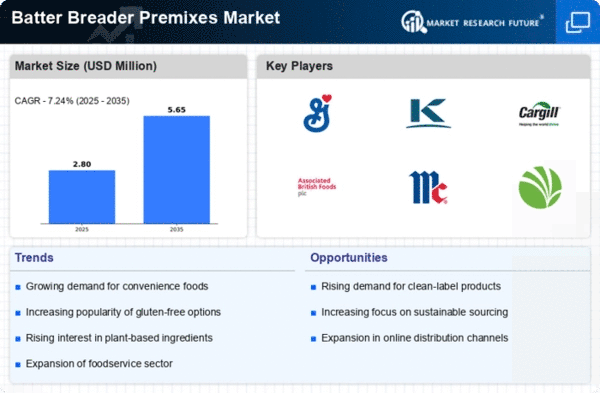

Market Growth Projections

The Global Batter and Breader Premixes Industry is poised for substantial growth, with projections indicating a market value of 3500 USD Million in 2024 and an anticipated increase to 5500 USD Million by 2035. This growth trajectory suggests a compound annual growth rate of 4.19% from 2025 to 2035. Such projections highlight the industry's resilience and adaptability in meeting evolving consumer demands. The increasing incorporation of batter and breader premixes across various food segments, including snacks and ready-to-eat meals, underscores the market's potential. As consumer preferences continue to evolve, the industry is likely to witness further innovations and expansions.

Health and Wellness Trends

The Global Batter and Breader Premixes Industry is also shaped by the growing health and wellness trends among consumers. There is a rising preference for healthier food options, prompting manufacturers to innovate and develop premixes that cater to this demand. This includes the introduction of gluten-free, low-calorie, and organic batter and breader options. As consumers become more health-conscious, the market is likely to adapt, potentially leading to a compound annual growth rate of 4.19% from 2025 to 2035. This shift not only reflects changing dietary preferences but also indicates a broader trend towards healthier eating habits, which could reshape product offerings in the industry.

Expansion of Food Service Sector

The Global Batter and Breader Premixes Industry is significantly influenced by the expansion of the food service sector, which includes restaurants, cafes, and fast-food chains. As dining out becomes increasingly popular, food service establishments are adopting batter and breader premixes to enhance the flavor and texture of their offerings. This trend is evidenced by the robust growth in the food service sector, which is expected to contribute to the market's value reaching 5500 USD Million by 2035. The ability to provide consistent quality and reduce preparation time makes these premixes an attractive option for food service operators, thereby driving market growth.

Rising Demand for Convenience Foods

The Global Batter and Breader Premixes Industry experiences a notable surge in demand for convenience foods, driven by changing consumer lifestyles and preferences. As urbanization accelerates, consumers increasingly seek quick meal solutions that do not compromise on taste or quality. This trend is reflected in the projected market value of 3500 USD Million in 2024, as more food manufacturers incorporate batter and breader premixes into their product lines. The convenience food sector's growth is anticipated to bolster the market further, as it aligns with the fast-paced lifestyle of modern consumers, thereby enhancing the appeal of ready-to-cook and ready-to-eat products.

Growing Popularity of Ethnic Cuisines

The Global Batter and Breader Premixes Industry is witnessing a growing popularity of ethnic cuisines, which is influencing consumer choices and preferences. As globalization facilitates cultural exchange, consumers are increasingly exploring diverse culinary experiences. This trend encourages food manufacturers to incorporate unique flavors and textures into their products, utilizing batter and breader premixes to replicate authentic ethnic dishes. The demand for such products is likely to contribute to the market's expansion, as consumers seek to recreate restaurant-quality meals at home. This shift towards ethnic flavors reflects broader culinary trends and could lead to increased innovation within the industry.

Technological Advancements in Food Processing

Technological advancements in food processing play a crucial role in the Global Batter and Breader Premixes Industry. Innovations in production techniques, such as improved mixing and coating technologies, enhance the quality and consistency of premixes. These advancements enable manufacturers to produce a wider variety of products that meet diverse consumer preferences. As technology continues to evolve, it is expected to drive efficiency and reduce costs in the production process, thereby supporting market growth. The integration of automation and smart technologies in food processing could further streamline operations, making it easier for companies to respond to market demands.