Focus on Clean Label Products

The focus on clean label products is becoming increasingly prominent in the Batter And Breader Premixes Market. Consumers are becoming more discerning about the ingredients in their food, leading to a demand for transparency and simplicity in product formulations. This trend is reflected in the growing market for clean label food products, which has been projected to reach a value of over 180 billion dollars by 2025. Manufacturers are responding by reformulating their batter and breader premixes to eliminate artificial additives and preservatives, thereby appealing to health-conscious consumers. This shift not only enhances product appeal but also positions companies favorably within the Batter And Breader Premixes Market.

Expansion of Foodservice Sector

The expansion of the foodservice sector is significantly influencing the batter and breader premixes Market. With the rise of fast-casual dining and food trucks, there is an increasing need for high-quality premixes that can deliver consistent results in high-volume settings. The foodservice industry has been projected to grow at a rate of around 5% annually, which suggests a burgeoning market for batter and breader premixes. Restaurants and food outlets are increasingly adopting these premixes to streamline their operations and enhance menu offerings, thereby driving demand. This trend indicates a promising future for suppliers in the Batter And Breader Premixes Market.

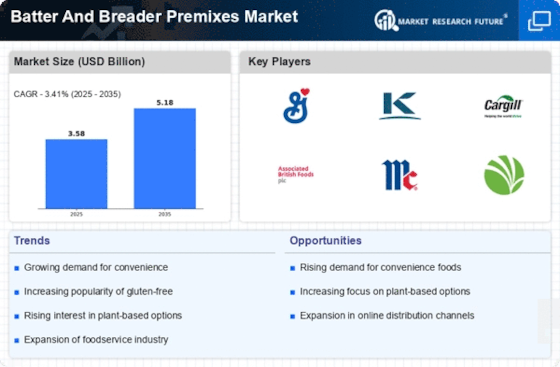

Rising Demand for Convenience Foods

The increasing consumer preference for convenience foods is a notable driver in the Batter And Breader Premixes Market. As lifestyles become busier, consumers are seeking quick meal solutions that do not compromise on taste or quality. This trend is reflected in the growing sales of ready-to-cook products, which often utilize batter and breader premixes to enhance flavor and texture. According to recent data, the convenience food sector has experienced a compound annual growth rate of approximately 4.5%, indicating a robust market potential for premixes. Manufacturers are responding by innovating their product lines to cater to this demand, thus propelling the growth of the Batter And Breader Premixes Market.

Growing Popularity of Ethnic Cuisines

The growing popularity of ethnic cuisines is another significant driver in the Batter And Breader Premixes Market. As consumers become more adventurous in their culinary choices, there is an increasing demand for premixes that cater to diverse flavor profiles. This trend is evident in the rising sales of products inspired by Asian, Latin American, and Mediterranean cuisines. Market Research Future indicates that the ethnic food segment is expected to grow at a rate of approximately 6% annually, which presents a lucrative opportunity for manufacturers of batter and breader premixes. By offering unique and authentic flavors, companies can tap into this expanding market, thereby enhancing their position in the Batter And Breader Premixes Market.

Adoption of Innovative Cooking Techniques

The adoption of innovative cooking techniques is emerging as a key driver in the Batter And Breader Premixes Market. Techniques such as air frying and sous-vide cooking are gaining traction among both consumers and professional chefs. These methods often require specialized premixes that can withstand unique cooking conditions while maintaining flavor and texture. The market for air fryers, for instance, has seen a surge, with sales increasing by over 20% in recent years. This shift towards healthier cooking options is likely to encourage the development of new batter and breader formulations, thus expanding the scope of the Batter And Breader Premixes Market.