Rising Obesity Rates

The increasing prevalence of obesity globally serves as a primary driver for the Global Bariatric Surgery Devices Market Industry. According to the World Health Organization, obesity rates have nearly tripled since 1975, with more than 1.9 billion adults classified as overweight. This alarming trend necessitates effective weight management solutions, leading to a growing demand for bariatric surgery devices. In 2024, the market is projected to reach 2.47 USD Billion, reflecting the urgent need for surgical interventions to combat obesity-related health issues. As awareness of obesity's health implications rises, the market is likely to expand further.

Technological Advancements

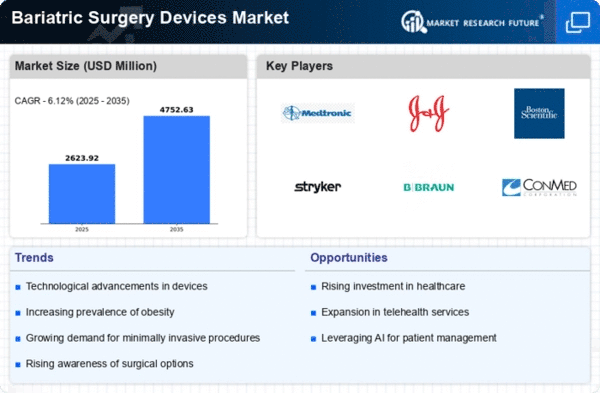

Technological innovations in bariatric surgery devices significantly enhance their effectiveness and safety, thereby propelling the Global Bariatric Surgery Devices Market Industry. Minimally invasive techniques, such as laparoscopic surgery, have gained traction, resulting in shorter recovery times and reduced complications. The introduction of advanced surgical instruments and robotic-assisted systems has further improved surgical outcomes. These advancements not only attract more patients but also encourage healthcare providers to adopt these technologies. As a result, the market is expected to grow, with projections indicating a rise to 4.75 USD Billion by 2035, driven by ongoing technological improvements.

Growing Awareness and Acceptance

The rising awareness and acceptance of bariatric surgery as a viable treatment option for obesity significantly influence the Global Bariatric Surgery Devices Market Industry. Educational campaigns and advocacy efforts by health organizations have helped to destigmatize surgical weight loss, encouraging individuals to consider surgical options. This shift in perception is crucial, as it leads to increased patient inquiries and consultations regarding bariatric procedures. As more patients seek surgical interventions, the market is poised for growth, with an anticipated increase in demand for various bariatric devices. This trend underscores the importance of education in driving market expansion.

Increasing Healthcare Expenditure

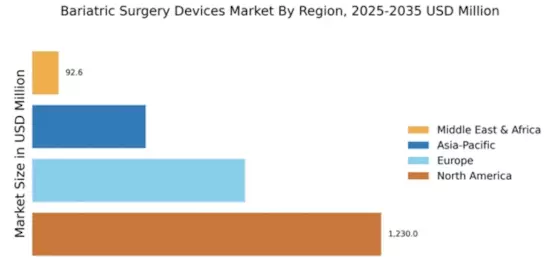

Rising healthcare expenditure across various regions contributes to the growth of the Global Bariatric Surgery Devices Market Industry. Governments and private sectors are investing more in healthcare infrastructure, which includes funding for obesity treatment programs. This trend is particularly evident in developed nations, where healthcare budgets are expanding to accommodate advanced surgical procedures. As healthcare systems allocate more resources to combat obesity, the demand for bariatric surgery devices is likely to increase. This financial commitment may lead to a compound annual growth rate of 6.13% from 2025 to 2035, reflecting the growing recognition of obesity as a critical public health issue.

Regulatory Support and Guidelines

Regulatory support and the establishment of guidelines for bariatric surgery play a pivotal role in shaping the Global Bariatric Surgery Devices Market Industry. Health authorities are increasingly recognizing the necessity of surgical interventions for obesity management, leading to the development of standardized protocols and approval processes for bariatric devices. This regulatory framework not only ensures patient safety but also fosters innovation within the industry. As regulatory bodies continue to endorse bariatric surgery, the market is likely to experience sustained growth, driven by the introduction of new devices and techniques that meet established safety and efficacy standards.