Emerging Markets

Emerging markets are becoming increasingly pivotal in the avionics Market, as countries in Asia-Pacific, Latin America, and Africa invest in their aviation infrastructure. These regions are witnessing a surge in air travel, prompting governments and private entities to enhance their aviation capabilities. The demand for modern avionics systems is rising, driven by the need for improved safety, efficiency, and compliance with international standards. As these markets develop, they present lucrative opportunities for avionics manufacturers to expand their reach and cater to a growing customer base. The potential for growth in these regions is substantial, as investments in aviation infrastructure are expected to continue, thereby propelling the Avionics Market forward.

Regulatory Compliance

Regulatory compliance remains a critical driver in the Avionics Market, as governments and aviation authorities impose stringent safety and performance standards. The need for compliance with regulations such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) has led to increased demand for advanced avionics systems that meet these requirements. This compliance not only ensures safety but also enhances the reliability of aircraft operations. The market is expected to witness a surge in demand for avionics solutions that facilitate compliance, particularly in emerging markets where regulatory frameworks are becoming more robust. Consequently, manufacturers are focusing on developing systems that align with these evolving regulations, thereby driving growth in the Avionics Market.

Technological Advancements

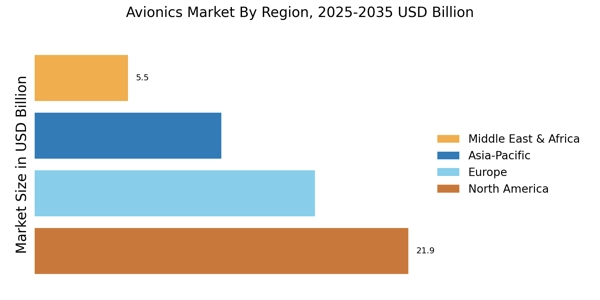

The Avionics Market is experiencing rapid technological advancements, particularly in the areas of automation and data analytics. Innovations such as artificial intelligence and machine learning are being integrated into avionics systems, enhancing decision-making processes and operational efficiency. The market is projected to grow at a compound annual growth rate of approximately 5.5% from 2025 to 2030, driven by the demand for smarter and more efficient aircraft systems. These advancements not only improve safety but also reduce operational costs, making them attractive to airlines and operators. As technology continues to evolve, the Avionics Market is likely to see increased investment in research and development, further propelling its growth.

Increased Air Travel Demand

The Avionics Market is significantly influenced by the rising demand for air travel, which has been steadily increasing over the years. As more individuals and businesses opt for air travel, airlines are compelled to enhance their fleet capabilities, leading to a greater need for advanced avionics systems. According to industry forecasts, air traffic is expected to double in the next two decades, necessitating the modernization of existing aircraft and the introduction of new models equipped with state-of-the-art avionics. This trend not only boosts the demand for avionics but also encourages manufacturers to innovate and improve their offerings. The interplay between increased air travel and avionics advancements is likely to shape the future landscape of the Avionics Market.

Focus on Safety and Security

Safety and security concerns are paramount in the Avionics Market, influencing the development and adoption of advanced avionics systems. With increasing threats to aviation security, there is a heightened emphasis on integrating robust security features into avionics solutions. This includes the implementation of advanced surveillance systems, cybersecurity measures, and real-time data monitoring to ensure the safety of passengers and cargo. The market is likely to see a growing demand for avionics systems that not only enhance operational safety but also address security challenges. As safety regulations become more stringent, manufacturers are expected to innovate and provide solutions that meet these evolving demands, thereby driving growth in the Avionics Market.