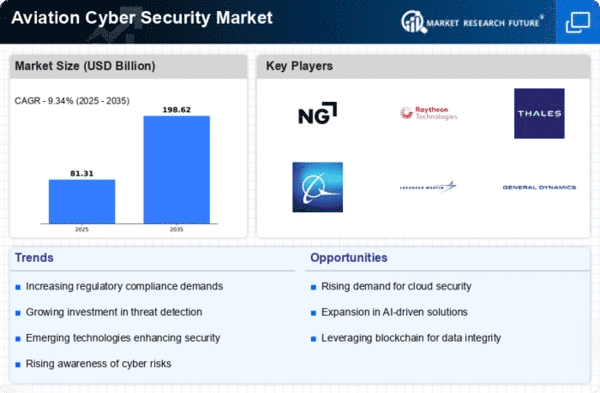

The Aviation Cyber Security Market is currently characterized by a dynamic competitive landscape, driven by increasing threats to aviation infrastructure and the growing need for robust security measures. Major players such as Northrop Grumman (US), Raytheon Technologies (US), and Thales Group (FR) are strategically positioned to leverage their technological expertise and extensive experience in defense and aerospace sectors. These companies are focusing on innovation and partnerships to enhance their cybersecurity offerings, thereby shaping a competitive environment that emphasizes advanced solutions and integrated systems.Key business tactics within this market include localizing manufacturing and optimizing supply chains to enhance responsiveness to regional security needs. The competitive structure appears moderately fragmented, with several key players exerting influence through strategic collaborations and technological advancements. This fragmentation allows for a diverse range of solutions, catering to various segments of the aviation industry, from commercial airlines to military applications.

In November Northrop Grumman (US) announced a partnership with a leading cloud service provider to enhance its cybersecurity capabilities for aviation systems. This collaboration aims to integrate advanced AI-driven analytics into their existing security frameworks, potentially improving threat detection and response times. Such strategic moves indicate a shift towards leveraging cloud technologies to bolster cybersecurity measures in aviation, reflecting a broader trend of digital transformation in the industry.

In October Raytheon Technologies (US) unveiled a new suite of cybersecurity solutions specifically designed for unmanned aerial vehicles (UAVs). This launch underscores the company's commitment to addressing emerging threats in the aviation sector, particularly as UAV usage continues to expand. By focusing on this niche market, Raytheon Technologies positions itself as a leader in UAV cybersecurity, which may enhance its competitive edge in a rapidly evolving landscape.

In September Thales Group (FR) secured a contract with a European airline to implement a comprehensive cybersecurity framework across its operations. This initiative not only strengthens the airline's defenses against cyber threats but also showcases Thales' capability to deliver tailored solutions that meet specific client needs. Such contracts are indicative of the growing demand for customized cybersecurity solutions in the aviation sector, further solidifying Thales' market position.

As of December current trends in the Aviation Cyber Security Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are increasingly shaping the competitive landscape, fostering innovation and collaboration. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on technological innovation, reliability of supply chains, and the ability to deliver comprehensive, integrated solutions that address the complex challenges of aviation cybersecurity.