Market Share

Avascular Necrosis Market Share Analysis

The demand for bone grafting surgeries is on the rise due to several important factors. Every year, around 2.2 million bone grafting surgeries take place globally, making bone the second most transplanted tissue after blood. Bone grafting is a surgical process used to address various bone-related issues by transplanting bone tissue to regenerate lost bone due to injuries or diseases. Traditionally, autografts, where the patient's own bone tissue is used, have been the gold standard in these procedures.

However, the double incisions required for autografts and the associated pain during and after the procedure have led scientists to explore alternatives. This shift in trend has led to a rise in the use of substitutes like allografts, xenografts, and synthetic bone grafts. These innovative substitutes are fueling the global market for bone graft substitutes, especially as cases of osteonecrosis, a condition related to bone death, continue to increase worldwide.

Additionally, the healthcare landscape in the US has witnessed a consolidation of large healthcare providers, including insurance companies and hospitals. This consolidation aims to leverage economies of scale and reduce treatment costs. This trend has led to increased purchasing power among these players, which could potentially decrease treatment costs. As major healthcare players grow larger, they can purchase high-tech osteonecrosis surgical products more economically, benefiting the bone graft market.

Technological advancements are another key driver in the market. Innovations such as recombinant DNA technology are expected to enhance the effectiveness of bone grafts. Biotechnology advancements are also enhancing synthetic bone graft characteristics, such as osteoconduction and osteoinduction. These technological advancements are poised to increase the efficiency of synthetic bone grafts and other surgical procedures, contributing to market growth.

Bone grafting surgeries are becoming more prominent worldwide, with an estimated 2.2 million procedures done each year, making bone the second most transplanted tissue globally after blood. This surgical procedure is used to address bone-related issues, involving the transplantation of bone tissue to restore bones lost due to disease or injury. Autografts, utilizing a patient's own bone tissue, have long been considered the gold standard in these procedures.

However, the process of autografting demands dual incisions, resulting in considerable procedural pain and subsequent post-operative discomfort in both areas. These challenges have driven scientists to explore alternatives to autografts. Consequently, the use of substitutes like allografts, xenografts, and synthetic bone grafts has been rising. These innovative substitutes are gaining popularity as replacements for real bones, fueling the global market for bone graft substitutes.

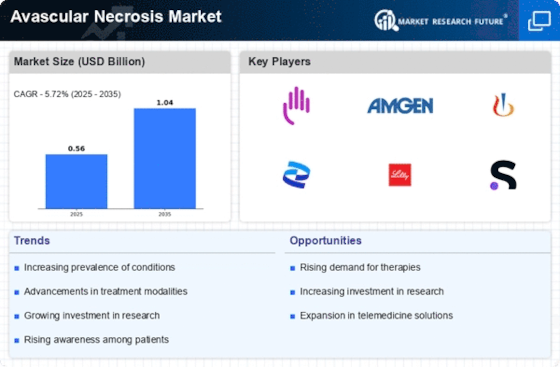

This surge in demand has been influenced by the increasing prevalence of osteonecrosis worldwide, thereby boosting the market for avascular necrosis products.

In the United States, there's been a noticeable consolidation among major healthcare providers, including insurance companies and hospitals. This consolidation aims to leverage economies of scale and reduce treatment costs. This move is expected to increase the collective buying power of these entities, eventually leading to reduced treatment expenses for patients. If successful, this reduction in treatment costs is anticipated to stimulate the market for bone graft products.

In recent years, there have been approximately 95 mergers, acquisitions, and joint ventures among hospitals in the U.S., with objectives ranging from enhancing efficiency and access to quality care to lowering costs through economies of scale. The health insurance market in the U.S. is increasingly concentrated among major players like Aetna, Anthem, Blue Cross and Blue Shield plans, Cigna, and United Health Group, collectively controlling a significant portion of the national insurance market. As these healthcare giants grow, their enhanced economic influence enables them to procure high-tech osteonecrosis surgical products more affordably, positively impacting the market.

Technological advancements are pivotal in shaping the future of the market. The growing utilization of recombinant DNA technology is expected to enhance the effectiveness of grafts. Furthermore, increased utilization of biotechnology is anticipated to enhance the properties of synthetic bone grafts, such as osteoconduction, osteoinduction, and osteogenesis. These technological strides are poised to boost the efficacy of synthetic bone grafts and other surgical procedures, consequently driving the market forward.

Leave a Comment