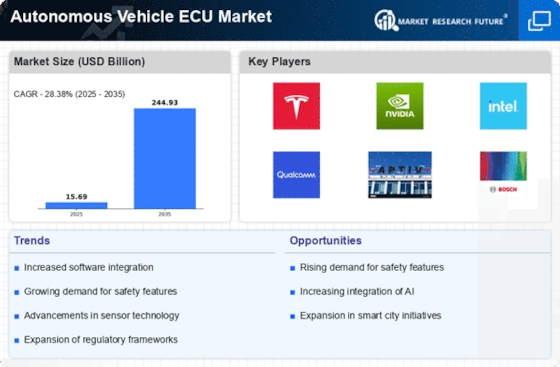

Top Industry Leaders in the Autonomous Vehicle ECU Market

Top listed companies in the Autonomous Vehicle ECU industry are:

Continental AG (Germany), Hitachi, Ltd. (Japan), Intel Corporation (U.S.), Nvidia Corporation (U.S.), and Renesas Electronics Corporation (Japan). ZF Friedrichshafen AG (Germany), NXP Semiconductors N.V. (Netherlands), Infineon Technologies AG (Germany), Bosch (Germany), and Autoliv Inc. (Sweden)

Established Dominators: Leveraging Legacy and Diversification

Traditional automotive giants like Continental, Bosch, and ZF Friedrichshafen leverage their deep-rooted industry expertise and extensive manufacturing prowess to maintain a stronghold. Continental, for instance, boasts a comprehensive ECU portfolio catering to various autonomy levels, coupled with strategic partnerships with tech giants like Intel and Baidu. Similarly, Bosch's foray into sensor technology and software development strengthens its position. These players capitalize on their existing supply chain networks and customer relationships, securing sizeable market shares.

Tech Powerhouses: Disrupting with Innovation and Partnerships

Tech behemoths like Intel, NVIDIA, and NXP Semiconductors inject disruptive innovation into the ecosystem. Intel's Mobileye acquisition bolstered its vision processing capabilities, while NVIDIA's Drive platform offers a robust hardware-software solution for autonomous driving. NXP, through its focus on high-performance processors and secure communication chips, caters to the critical aspects of safety and reliability. These players often forge alliances with automakers and established ECU players, blurring the lines of competition and collaboration.

Startups: Agility and Niche Expertise Drive Growth

A vibrant wave of startups is injecting dynamism into the market with their nimbleness and focus on niche areas. Companies like Aurora, Zoox, and Cruise are at the forefront of developing Level 4 and 5 autonomous driving systems, pushing the technological boundaries. Others, like Uhnder and Blackboxchips, specialize in specific ECU functionalities like sensor fusion or cybersecurity, offering tailored solutions to OEMs. Their agility and ability to rapidly adapt to evolving technologies allow them to carve out distinct market segments.

Factors Shaking the Ground: Analyzing Market Share

Several key factors influence market share dynamics in this highly fluid landscape:

Technology Leadership: Companies at the forefront of AI, sensor fusion, and high-performance computing hold a significant advantage.

Strategic Partnerships: Synergies between automakers, tech giants, and startups create formidable ecosystems, propelling market share gains.

Regional Regulations: The pace of autonomous vehicle adoption varies across regions, impacting demand for specific ECU technologies.

Cost Optimization: Players offering cost-effective and scalable solutions gain traction, especially in budget-conscious markets.

Future Gazing: Emerging Trends Reshaping the Game

The competitive landscape is constantly evolving, fueled by several emerging trends:

Integration and Consolidation: Expect mergers and acquisitions as players seek to strengthen their technology stacks and global reach.

Software-Defined ECUs: The ECU architecture is evolving towards software-defined platforms, enabling flexible updates and remote diagnostics.

Cybersecurity Focus: As vehicles become increasingly connected, robust cybersecurity measures become a key differentiator.

Sustainability Imperative: ECUs with low power consumption and eco-friendly materials will gain favor as sustainability concerns rise.

Overall Scenario: A Collaborative Race Towards Autonomy

While competition is fierce, the autonomous vehicle ECU market is characterized by a growing sense of collaboration. Partnerships and alliances across the value chain are crucial for overcoming technological hurdles and navigating complex regulatory landscapes. Ultimately, success hinges on a delicate balance between individual differentiation, strategic partnerships, and a shared vision of shaping the future of mobility. This dynamic and collaborative race towards autonomous driving promises exciting developments in the years to come, with established players, tech giants, and nimble startups all vying for a piece of the ever-expanding pie.

Latest Company Updates:

Continental AG (Germany):

• December 2023: Announced strategic partnership with Microsoft for developing cloud-based solutions for ADAS and autonomous driving, focusing on data management and AI. Hitachi, Ltd. (Japan):

• November 2023: Completed successful testing of autonomous trucks in partnership with Isuzu Motors using Hitachi's LuMIflex autonomous driving platform. Intel Corporation (U.S.):

• January 2024: Announced Mobileye EyeQ Ultra chip, specifically designed for Level 4 autonomous driving, with increased processing power and AI capabilities.

Nvidia Corporation (U.S.):

• December 2023: Released DRIVE Hyperion 9.0 software platform, featuring improved sensor fusion and perception algorithms for autonomous driving.

*Disclaimer: List of key companies in no particular order