Technological Innovations

Technological innovations play a pivotal role in shaping the Autonomous Utility Vehicle Market. Advancements in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of autonomous vehicles. For example, the integration of advanced GPS and LiDAR systems allows for precise navigation and obstacle detection, which is crucial for operational safety. The market is witnessing significant investments in research and development, with companies focusing on improving the reliability and efficiency of autonomous utility vehicles. This technological evolution is expected to drive market growth, as more industries recognize the benefits of adopting these advanced vehicles.

Increased Demand for Automation

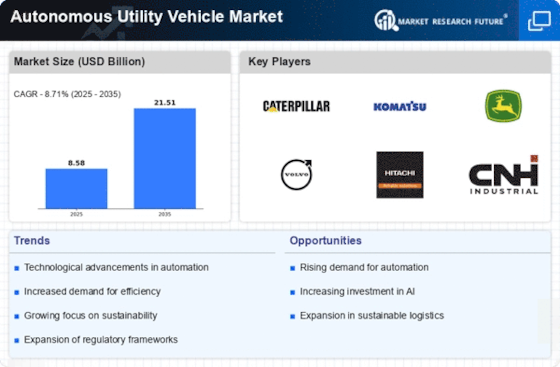

The Autonomous Utility Vehicle Market is experiencing a surge in demand for automation across various sectors, including agriculture, construction, and logistics. This demand is driven by the need for enhanced efficiency and productivity. For instance, the agricultural sector is increasingly adopting autonomous vehicles to optimize crop management and reduce labor costs. According to recent data, the market for autonomous agricultural vehicles is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend indicates a broader acceptance of automation technologies, which is likely to propel the Autonomous Utility Vehicle Market forward.

Regulatory Frameworks and Support

The development of supportive regulatory frameworks is crucial for the Autonomous Utility Vehicle Market. Governments are increasingly recognizing the potential benefits of autonomous vehicles, leading to the establishment of regulations that facilitate their integration into existing transportation systems. For example, several countries have implemented pilot programs to test autonomous utility vehicles in controlled environments. These initiatives not only provide valuable data for further development but also instill confidence in potential investors. As regulatory support continues to evolve, it is expected to create a more favorable environment for the growth of the Autonomous Utility Vehicle Market.

Cost Reduction and Efficiency Gains

The Autonomous Utility Vehicle Market is significantly influenced by the potential for cost reduction and efficiency gains. Businesses are increasingly recognizing that autonomous vehicles can lower operational costs by minimizing labor expenses and reducing the likelihood of human error. For instance, logistics companies utilizing autonomous delivery vehicles report a decrease in delivery times and operational costs by up to 30%. This financial incentive is compelling many organizations to invest in autonomous utility vehicles, thereby accelerating market growth. As companies seek to enhance their competitive edge, the demand for these vehicles is likely to rise.

Sustainability and Environmental Concerns

Sustainability and environmental concerns are becoming increasingly prominent in the Autonomous Utility Vehicle Market. As industries strive to reduce their carbon footprints, the adoption of electric and hybrid autonomous vehicles is gaining traction. These vehicles are designed to operate with lower emissions, aligning with global sustainability goals. For instance, the construction sector is exploring autonomous electric vehicles to minimize environmental impact while maintaining productivity. This shift towards greener technologies is likely to attract investment and drive innovation within the Autonomous Utility Vehicle Market, as companies seek to meet both regulatory requirements and consumer expectations.