Emergence of 5G Technology

The emergence of 5G technology is poised to have a transformative impact on the Autonomous Networks Market. With its promise of ultra-fast data speeds and low latency, 5G is enabling new applications and services that require robust network capabilities. The deployment of 5G networks is expected to create a substantial demand for autonomous solutions that can manage the complexities associated with this advanced technology. Market forecasts indicate that the 5G infrastructure market will exceed USD 300 billion by 2025, highlighting the potential for growth within the Autonomous Networks Market. As organizations seek to leverage the benefits of 5G, the integration of autonomous networks will be essential for optimizing performance and ensuring seamless connectivity.

Rising Demand for Network Automation

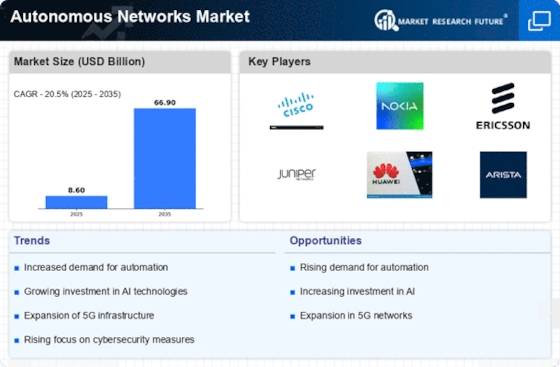

The Autonomous Networks Market is experiencing a notable surge in demand for network automation solutions. Organizations are increasingly recognizing the need to streamline operations and enhance efficiency. According to recent data, the market for network automation is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is driven by the necessity for businesses to reduce operational costs and improve service delivery. As enterprises seek to automate routine tasks, the Autonomous Networks Market is positioned to provide innovative solutions that facilitate this transition. The integration of automation technologies not only enhances productivity but also allows for more agile responses to market changes, thereby solidifying the role of autonomous networks in modern business strategies.

Advancements in Artificial Intelligence

The Autonomous Networks Market is significantly influenced by advancements in artificial intelligence (AI). AI technologies are being integrated into network management systems, enabling predictive analytics and automated decision-making processes. This integration allows for real-time monitoring and optimization of network performance, which is crucial for maintaining service quality. Recent studies indicate that AI-driven solutions can reduce network downtime by up to 30%, thereby enhancing overall operational efficiency. As organizations increasingly adopt AI technologies, the demand for autonomous networks is expected to rise correspondingly. The ability to leverage AI for proactive network management positions the Autonomous Networks Market as a key player in the evolution of telecommunications and IT infrastructure.

Increased Focus on Operational Efficiency

The Autonomous Networks Market is witnessing an increased focus on operational efficiency as organizations strive to optimize their network performance. Businesses are under constant pressure to deliver high-quality services while managing costs effectively. The implementation of autonomous networks allows for the automation of routine tasks, freeing up valuable resources for strategic initiatives. Recent analyses suggest that companies adopting autonomous solutions can achieve up to a 40% reduction in operational costs. This emphasis on efficiency is prompting organizations to invest in technologies that enhance their network capabilities, thereby propelling the growth of the Autonomous Networks Market. As efficiency becomes a critical success factor, the demand for innovative network solutions is likely to escalate.

Growing Need for Enhanced Security Protocols

In the context of the Autonomous Networks Market, the growing need for enhanced security protocols is becoming increasingly apparent. With the rise in cyber threats and data breaches, organizations are prioritizing the implementation of robust security measures within their network infrastructures. The market for network security solutions is anticipated to reach USD 50 billion by 2026, reflecting a heightened focus on safeguarding sensitive information. Autonomous networks, equipped with advanced security features, can autonomously detect and respond to potential threats, thereby minimizing risks. This proactive approach to security not only protects organizational assets but also fosters trust among customers and stakeholders, further driving the adoption of autonomous networks.