Rising Demand for Automation

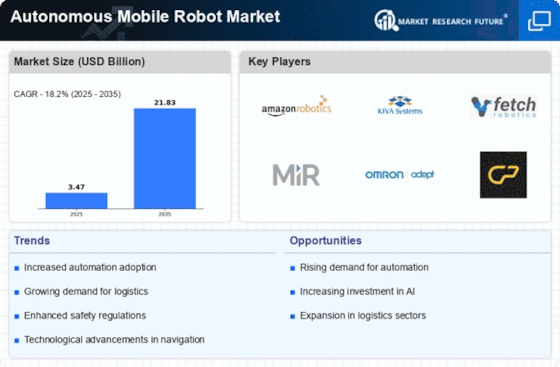

The Autonomous Mobile Robot Market experiences a notable surge in demand for automation across various sectors. Industries are increasingly recognizing the efficiency and cost-effectiveness that autonomous mobile robots can provide. For instance, the logistics sector has seen a significant uptick in the deployment of these robots to streamline operations and reduce labor costs. According to recent data, the market for automation solutions is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend indicates a strong inclination towards integrating autonomous mobile robots into existing workflows, thereby enhancing productivity and operational efficiency. As businesses strive to remain competitive, the adoption of automation technologies, including autonomous mobile robots, appears to be a strategic imperative.

Evolving Consumer Expectations

Consumer expectations are evolving rapidly, influencing the Autonomous Mobile Robot Market. As customers demand faster and more efficient services, businesses are compelled to adopt innovative solutions to meet these expectations. Autonomous mobile robots are increasingly viewed as a viable solution to enhance service delivery, particularly in sectors such as retail and hospitality. The ability of these robots to operate autonomously and efficiently can significantly improve customer satisfaction. Market data suggests that companies implementing autonomous solutions report higher customer retention rates and improved service levels. This shift in consumer behavior is likely to drive further investment in autonomous mobile robots, as businesses seek to align their operations with the changing landscape of consumer demands.

Growing Need for Safety and Compliance

The growing need for safety and compliance is increasingly influencing the Autonomous Mobile Robot Market. As industries face stringent regulations and safety standards, the adoption of autonomous mobile robots is seen as a means to enhance workplace safety and ensure compliance. These robots can perform hazardous tasks, reducing the risk of accidents and injuries among human workers. Furthermore, the integration of autonomous mobile robots can help organizations adhere to regulatory requirements more effectively. Market analysis indicates that sectors such as manufacturing and warehousing are particularly focused on leveraging autonomous solutions to improve safety protocols. This heightened emphasis on safety and compliance is likely to drive the demand for autonomous mobile robots, as businesses seek to create safer working environments.

Technological Advancements in Robotics

Technological advancements play a crucial role in shaping the Autonomous Mobile Robot Market. Innovations in robotics, such as enhanced navigation systems, improved sensors, and sophisticated AI algorithms, are enabling the development of more capable and versatile autonomous mobile robots. These advancements not only enhance the operational efficiency of robots but also expand their applicability across various sectors, including manufacturing, healthcare, and agriculture. The integration of advanced technologies is expected to propel the market forward, with projections indicating a potential market size exceeding several billion dollars within the next few years. As technology continues to evolve, the capabilities of autonomous mobile robots are likely to expand, further driving their adoption across diverse industries.

Increased Investment in Research and Development

Investment in research and development is a key driver for the Autonomous Mobile Robot Market. Companies are increasingly allocating resources to innovate and enhance their robotic solutions, aiming to stay ahead in a competitive landscape. This focus on R&D is fostering the development of next-generation autonomous mobile robots that are more efficient, reliable, and capable of performing complex tasks. Recent statistics indicate that R&D spending in the robotics sector is expected to grow significantly, reflecting the industry's commitment to innovation. As companies strive to develop cutting-edge technologies, the influx of investment in R&D is likely to accelerate the growth of the autonomous mobile robot market, paving the way for new applications and improved functionalities.