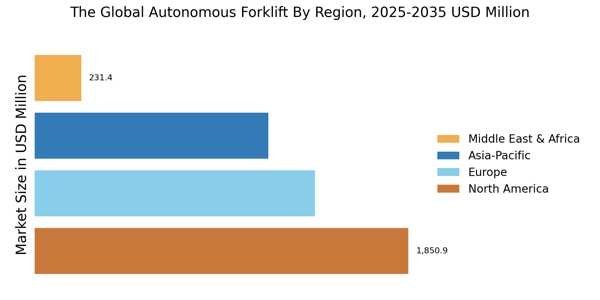

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia Pacific Autonomous Forklift Market accounted for ~44% in 2022. the region's large manufacturing and logistics industries, as well as the increasing adoption of automation and robotics in these sectors. The use of autonomous forklifts is expected to grow significantly in the coming years as companies seek to improve efficiency, productivity, and safety in their material handling and transportation operations.

One of the key factors driving the demand for autonomous forklifts in Asia Pacific is the region's large manufacturing industry. The use of automation and robotics is becoming increasingly prevalent in manufacturing operations, and autonomous forklifts can help manufacturers streamline their material handling and transportation processes, reduce labor costs, and increase productivity. The logistics industry is also a significant market for autonomous forklifts in Asia Pacific, with companies seeking to optimize their supply chain management, reduce the time required for order fulfillment, and enhance the overall customer experience.

FIGURE 3: AUTONOMOUS FORKLIFT MARKET SIZE BY REGION 2022 VS 2032 (USD Million)

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe market accounts for the second-largest market share. the region's strong manufacturing and logistics industries, as well as the increasing adoption of automation and robotics in these sectors. The use of autonomous forklifts is expected to grow significantly in the coming years as companies seek to improve efficiency, productivity, and safety in their material handling and transportation operations. One of the key factors driving the demand for autonomous forklifts in Europe is the region's strong manufacturing industry.

The use of automation and robotics is becoming increasingly prevalent in manufacturing operations, and autonomous forklifts can help manufacturers streamline their material handling and transportation processes, reduce labor costs, and increase productivity. The logistics industry is also a significant market for autonomous forklifts in Europe, with companies seeking to optimize their supply chain management, reduce the time required for order fulfillment, and enhance the overall customer experience.

The North America Autonomous Forklift Market is expected to grow at the fastest CAGR between 2022 and 2032. The use of autonomous forklifts is expected to grow significantly in the coming years as companies seek to improve efficiency, productivity, and safety in their material handling and transportation operations. One of the key factors driving the demand for autonomous forklifts in North America is the region's strong manufacturing industry. The use of automation and robotics is becoming increasingly prevalent in manufacturing operations, and autonomous forklifts can help manufacturers streamline their material handling and transportation processes, reduce labor costs, and increase productivity.

The retail industry is also a significant market for autonomous forklifts in North America, with companies seeking to improve inventory management, product replenishment, and order fulfillment through automation.