Market Trends

Key Emerging Trends in the Autonomous Construction Equipment Market

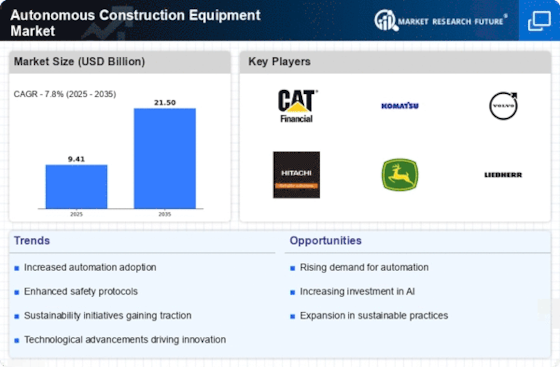

The market of Autonomous Construction Equipment saw a huge upshoot in the last few years, based on the advancing technology and the increasing search for efficiency within construction industry. Among the most important market trends is that of disconnected features integration into construction equipment. As automation rapidly advances, construction equipment producers are using such technologies as GPS, sensors, and artificial intelligence to create unattended jobs. This development is redefining the old schoolbuilding practice methods by increasing precision, decreasing chance of human error, and boosting productivity.

Given the fact of the rising popularity of self-propelled construction equipment, issues existing in the industry can be dealed with by accordingly. Safety is always the number one priority during construction projects and that’s why the autonomous equipment is developed to solve the risks of human manned equipment. These self-suffice systems are put with intricate sensors that can detect barriers, monitor the environment and make instant decisions to prevent collisions among others. As the market executes, we are noticing the growing inclination of companies towards autonomy because they give a lot of attention to worker safety as well as minimization of incidents on the site.

Besides cost-effectiveness, marketized developments in autonomous construction equipment are driven by other factors. These modern machines are performance orientated with reduced fuel consumption, reduced operating expenses and increased project speed. With uses of autonomous systems, complex construction tasks can be accomplished with higher accuracy and consistency, such as efficient use of resources, consequently. It not only assures cost reduction while at work but also helps in project completion within a shorter time, therefore making this equipment attractive for construction companies who want to save on their bottom line by investing in this equipment.

Being ecofriendly is one of the leading trends in construction sphere and autonomous technology is in line with this ecocentric approach. Compared with traditional labor manned machinery that generates a lot of pollution, autonomous construction machinery has been designed to be power efficient and emits lesser pollution when in use. Given the intensifying global programs and regulartions that aim for sustainablity to be intensified, the adoption of automated construction equipments can be expected to accelerate, owing to the industry's intent to minimize its environmental impact.

Leave a Comment