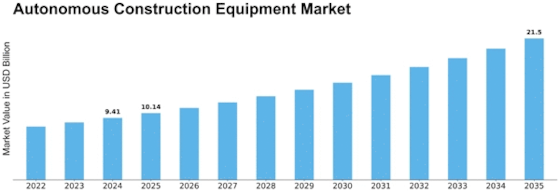

Autonomous Construction Equipment Size

Autonomous Construction Equipment Market Growth Projections and Opportunities

The Autonomous Construction Equipment Market is undergoing massive changes due to a number factors this market is influenced by. Among other activities these market characteristics are strongly influenced by growing demands for an efficiency and productivity which is observed on the construction market. When the process involve more and more precise tasks and less time, the demand for autonomous construction machinery grows. The deployment of such cutting-edge technologies provide the opportunity for humans to delegate and work with the machines to achieve a much higher level of precision and speed in multiple aspects of construction works.

Another key factor of the market is the expanded focus of the construction industry on the safety. Autonomous construction devices minimize the need for human labor in dangerous situations and therefore minimizing the possibilities of accidents and jobs injuries. The introduction of sensors, cameras, and artificial intelligence into these machines increases their capacity to identify hazards and obstacles, and safely steer around potential danger. Therefore, the demand for self-driving construction equipment has been on the rise, given the need for security which is the number one concern for the global construction market.

On the other hand, we cannot ignore the fact that digitalization and connectivity as well as a construction industry tend to drive the growth of autonomous construction equipment market. These cars feature telematics technology that allows for the monitoring of performance as well as data collection in real time. These data can be applied for predictive maintenance, optimizing tools performance, and reducing the period of downtime. The incorporation of “IoT” (Internet of Things) in the connectivity and networking of autonomous equipment for construction enhances the ability to save time and cost effectively in construction projects.

High cost-efficiency is one market issues for the adoption of autonomous construction equipment The upfront investment in these highly advanced machines might be higher at first, but the paybacks in terms of salary cut, increased efficiency and reduced operational costs make them an option worth considering by construction companies. Automation of cyclical occupations producing enormous savings of labor, thus freeing human workers to perform more complicated and strategic elements of constructing projects.

Issues surrounding the environment will definitely be the main drivers of the demand for autonomous construction machines. The construction business is gradually becoming aware of the need to minimize the environmental pollution and the autonomous machines have an effect towards this objective. Such machines are capable of being tuned for the fuels which are environment-friendly thus aligning with the objectives. Autonomous equipment, in addition, can operate precisely and hence the use of materials is lowered which is aligned with environmentally friendly building approaches.

Leave a Comment