Expansion of the Automotive Sector

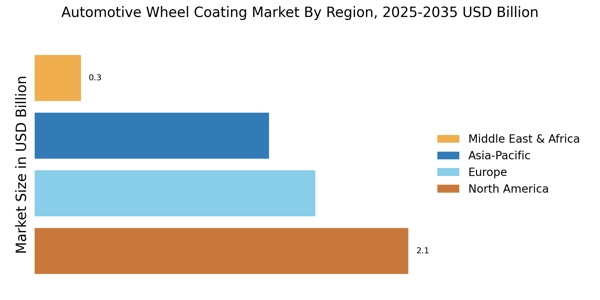

The ongoing expansion of the automotive sector is a crucial driver for the Automotive Wheel Coating Market. As vehicle production increases, so does the demand for high-quality wheel coatings that enhance both performance and aesthetics. Emerging markets are witnessing a rise in automotive manufacturing, which is expected to contribute to a significant increase in coating requirements. The automotive industry is projected to grow at a CAGR of approximately 4% in the coming years, thereby creating opportunities for coating manufacturers to innovate and expand their offerings. This growth is likely to stimulate competition and drive advancements in coating technologies, further benefiting the market.

Technological Innovations in Coatings

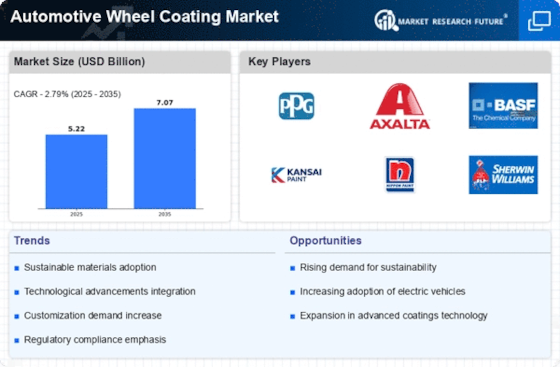

The Automotive Wheel Coating Market is experiencing a surge in technological innovations that enhance the performance and durability of coatings. Advanced formulations, such as nanotechnology-based coatings, are being developed to provide superior resistance to corrosion, scratches, and UV degradation. These innovations not only improve the longevity of wheel coatings but also contribute to aesthetic appeal, as they can be engineered to offer a variety of finishes. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next five years, driven by these advancements. Manufacturers are increasingly investing in research and development to create coatings that meet the evolving demands of consumers and automotive manufacturers alike.

Rising Demand for Lightweight Materials

The shift towards lightweight materials in the automotive sector is significantly influencing the Automotive Wheel Coating Market. As manufacturers strive to enhance fuel efficiency and reduce emissions, the demand for lightweight wheels has increased. This trend necessitates the development of specialized coatings that can adhere to various lightweight materials, such as aluminum and magnesium alloys. The market for lightweight wheels is expected to expand, with projections indicating a growth rate of around 6% annually. Consequently, the coatings used must not only provide protection but also complement the performance characteristics of these materials, thereby driving innovation within the industry.

Increased Focus on Aesthetic Customization

Consumer preferences are shifting towards personalized vehicles, which is propelling the Automotive Wheel Coating Market. Aesthetic customization has become a key factor for car owners, leading to a rise in demand for unique and visually appealing wheel coatings. This trend is particularly evident among younger demographics who seek to express their individuality through their vehicles. The market is witnessing a variety of color options, finishes, and textures, catering to diverse consumer tastes. As a result, manufacturers are expanding their product lines to include customizable coatings, which is likely to contribute to a projected market growth of 4% over the next few years.

Regulatory Compliance and Environmental Standards

The Automotive Wheel Coating Market is increasingly influenced by stringent regulatory compliance and environmental standards. Governments are implementing regulations aimed at reducing volatile organic compounds (VOCs) and promoting eco-friendly coating solutions. This has led to a growing demand for water-based and low-VOC coatings, which are not only compliant with regulations but also appeal to environmentally conscious consumers. The market is adapting to these changes, with manufacturers investing in sustainable practices and materials. It is anticipated that the shift towards environmentally friendly coatings will drive market growth, with an expected increase of 5% in the adoption of such products over the next few years.