Automotive Upholstery Size

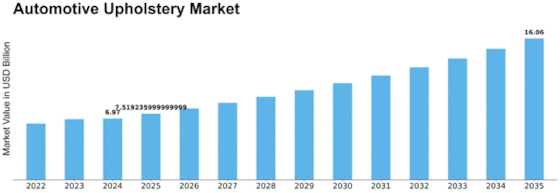

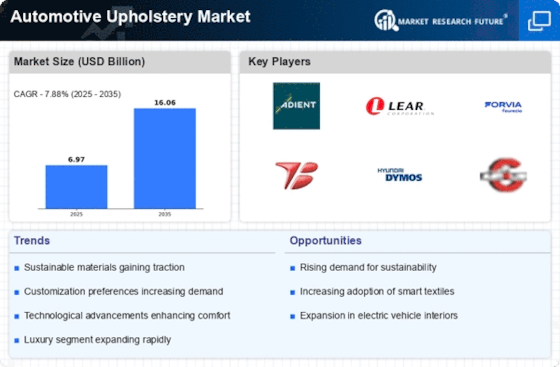

Automotive Upholstery Market Growth Projections and Opportunities

Numerous market dynamics influence the vehicle upholstery market, shaping its elements considerably. The need for creative and aesthetically pleasing upholstery materials is growing as new designs and models are released. Consumer preferences play a big influence, with comfort, strength, and style becoming increasingly important. To be competitive, manufacturers in the car upholstery sector must constantly adapt to these shifting preferences. The market is also sensitive to changes in natural ingredient prices, as these directly affect production costs. In order to develop pricing schemes that balance customer reasonableness with benefit, upholstery manufacturers ought to investigate these financial aspects. Manufacturers of automobiles and upholstery suppliers are adapting to this trend by incorporating environmentally friendly practices into their production procedures. Organizations operating in this market must adhere to strict natural norms, and those who prioritize maintainability will likely gain an advantage. Materials innovations, such as clever textures that can regulate temperature or those that are stain-resistant, are gaining traction. Additionally, the integration of innovation within automobiles—such as warming components and sensors embedded in upholstery—is becoming more commonplace. These advancements enhance the overall driving experience and contribute to the growth of the market by providing new opportunities for manufacturers to differentiate their products. Predispositions to particular surfaces, instances, and tones may vary among communities and geographical places. As automakers manage many global markets, it becomes increasingly important to comprehend and adapt to these social nuances. To stay ahead of this particular market, persistently innovative work efforts to create state-of-the-art materials and plans are also essential. Prosperous participants in this field are those who adapt to shifting consumer preferences, adopt cost-effective strategies, drive technological innovations, and nimbly investigate global markets. The car upholstery market will undoubtedly follow the same trajectory as the automotive sector continues to grow, bringing with it both challenges and opportunities for industry partners.

Leave a Comment