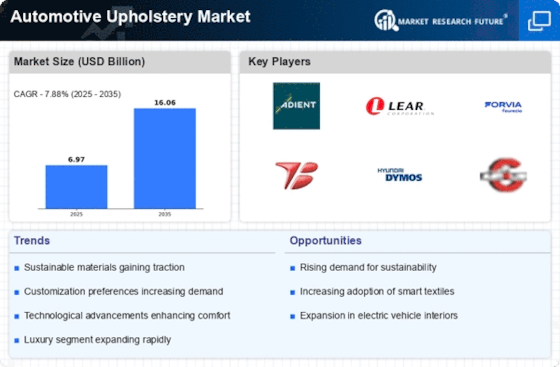

Market Share

Automotive Upholstery Market Share Analysis

A notable approach involves the use of high-quality materials and creative planning to separate goods. This approach helps brands stand apart in a crowded market and accommodate various consumer preferences. Evaluation is a major component of the Automotive Upholstery Market's market share positioning methodology. Some firms focus on providing practical options without sacrificing quality. This strategy appeals particularly to price-conscious consumers who seek reasonableness without compromising comfort or stability. Businesses can benefit from a wider customer base by raising the price of their products, opening their contributions to a wider spectrum of consumers. Businesses invest money in creative projects to include cutting-edge components and features into their products. Mechanical advancements, such as the integration of intelligent materials possessing temperature-regulating capabilities or the development of sustainable and environmentally friendly materials, establish companies as industry leaders. Businesses in the automotive upholstery market often form alliances with automakers in order to get preference as suppliers to original equipment manufacturers (OEMs). Upholstery manufacturers may capture a significant share of the market and benefit from long-term contracts and increased visibility by establishing strong points of differentiation with leading auto brands. This tactic uses the reputation and market dominance of well-established automakers to force the upholstery manufacturer into a distinctive position within the industry. This method includes managing market research, soliciting feedback from clients, and keeping an eye out for emerging trends. Organizations can retain current customers and attract new ones by tailoring their contributions to consumer assumptions, so solidifying their market dominance. As the global automotive upholstery market continues to grow, companies are focusing on expanding into emerging areas. This entails arranging circulation structures, constructing memorability in various areas, and modifying goods to fit local preferences and regulations. Organizations can increase their market share and reduce their reliance on certain regions by aggressively venturing into new markets and taking advantage of untapped customer bases. In the Automotive Upholstery Market, long-term success and growth remain contingent on efficient market share positioning in an industry driven by consumer preferences, quality, and innovation.

Leave a Comment