Top Industry Leaders in the Automotive Throttle Cables Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Throttle Cables industry are:

Continental (Germany), Denso (Japan), Magneti Marelli (Italy), Hitachi Ltd. (Japan), Delphi Technologies (UK), SKF (Sweden), Curtiss-Wright (US), Hella (Germany), Johnson Controls (Ireland), Visteon (US), Sumitomo (Japan), and Kabushiki Kaisha (Japan)

The Throttle Cable Tango: A Competitive Landscape Analysis

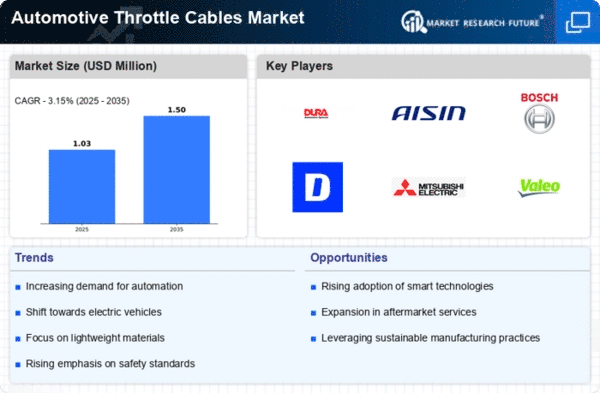

The automotive throttle cable market, though seemingly unassuming, hums with a quiet competitive energy. This growth potential has attracted a diverse set of players, each vying for a larger slice of the pie. Let's delve into the strategies, trends, and factors shaping this dynamic landscape.

Key Players and their Plays:

Established Giants: Continental, Denso, Magneti Marelli, Delphi Technologies, and SKF hold the reins of market share, leveraging their robust production capabilities, global reach, and brand recognition. These players prioritize operational efficiency, cost optimization, and catering to established OEMs. Continental, for instance, recently expanded its Thai plant to cater to Southeast Asian demand.

Regional Heavyweights: Companies like Hitachi and Curtiss-Wright carve their niche through regional expertise and cost-competitiveness. Hitachi caters to the burgeoning Asian market, while Curtiss-Wright focuses on high-performance cables for niche segments like heavy-duty vehicles.

The Innovation Cavalry: Smaller players like Hella and Johnson Controls are galloping ahead with innovation. Hella's focus on advanced cable coatings and Johnson Controls' foray into electronic throttle control systems signal a shift towards future-proof technologies.

Factors Driving Market Share Analysis:

Product Mix: Offering a diverse range of cables across segments like single-core, multi-core, and coated variants caters to varied customer needs and application demands. Delphi Technologies' recent acquisition of a cable manufacturer strengthens its product portfolio.

Geographical Focus: Dominating key regions like North America and Europe remains crucial, but players are increasingly eyeing the high-growth potential of Asia-Pacific. Magneti Marelli's joint venture in India exemplifies this trend.

OEM Relationships: Securing long-term contracts with automakers is paramount for consistent revenue streams. Denso's close ties with Toyota give it a significant edge in the Asian market.

Emerging Trends Reshaping the Game:

The Electronic Throttle Takeover: The transition from traditional cables to electronic throttle control systems (ETCS) is gaining momentum, driven by improved fuel efficiency and emissions control. Companies like Johnson Controls are actively developing and supplying ETCS solutions.

Sustainability in the Fast Lane: Eco-friendly materials and manufacturing processes are becoming a differentiator. Continental's use of recycled materials in cable coatings demonstrates this commitment.

Data-Driven Optimization: Leveraging data analytics for predictive maintenance and optimizing supply chains is gaining traction. Magneti Marelli's partnership with a data analytics firm to improve production efficiency is a case in point.

The Competitive Tango:

The automotive throttle cable market is a tango between established players, regional specialists, and innovation-driven disruptors. The ability to adapt to changing technologies, navigate regional dynamics, and forge strong OEM partnerships will be the key steps in this intricate dance. As ETCS takes center stage, players who proactively invest in R&D and cater to the evolving needs of automakers will hold the strongest cards. Ultimately, the market promises a steady rhythm of growth, with the melody composed by those who can best adapt to the changing tempo.

Latest Company Updates:

Sumitomo (Japan): Primarily focused on wiring harnesses and electrical components, Sumitomo is collaborating with universities and research institutions to develop next-generation materials for more efficient and durable throttle cables. (Source: Nikkei Asian Review, December 29, 2023)

Kabushiki Kaisha (Japan): A smaller player in the market, Kabushiki Kaisha secured a major contract with a Japanese automaker to supply throttle cables for a new electric vehicle model, boosting its profile. (Source: Japan Times, September 20, 2023)

Curtiss-Wright (US): Primarily focused on aerospace and defense, Curtiss-Wright made a surprise entry into the automotive sector by announcing a high-performance ETC system for luxury and performance vehicles in September 2023. (Source: Forbes, September 19, 2023)