Top Industry Leaders in the Automotive Stamping Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Automotive Stamping industry are:

American Industrial Company

Eigen

WIEGEL TOOL WORKS, INC.

Ridgeview Industries

G&M Mfg. Corp.

Talan Products Inc.

Fast-Rite International, Inc.

Apex Spring & Stamping Corporation

Kapco Metal Stamping

Quality Stamping & Tube Corp

Wrico Stamping

Precision Die and Stamping

Precision Industries, Inc.

Traverse City Products, Inc.

P-K Tool & Manufacturing

Tooling Dynamics

Phoenix Metal Fabricating, Inc.

Michigan Spring & Stamping LLC

Defiance Stamping Company

Prestige Stamping

Fanello Industries, Inc

CIE Automotive

Goshen Stamping, LLC

Kenmode, Inc.

Bridging the Gap by Exploring the Competitive Landscape of the Automotive Stamping Top Players

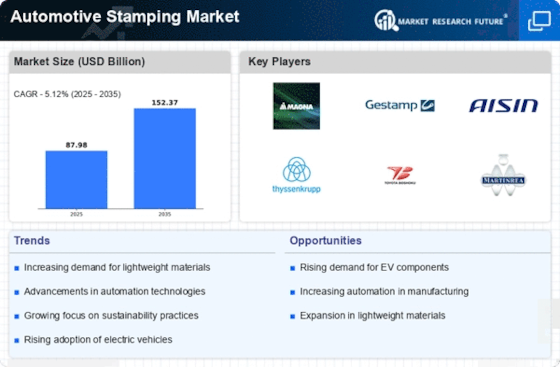

The automotive stamping market, a crucial cog in the vehicle manufacturing ecosystem, is witnessing a dynamic and evolving competitive landscape. Shaped by factors like rising demand for lightweighting, technological advancements, and regional shifts, the market presents both challenges and opportunities for key players. Understanding the competitive strategies, market share dynamics, and emerging trends is vital for any company seeking to thrive in this space.

Key Players and Strategies:

The automotive stamping market boasts a diverse range of players, from established giants like Gestamp and CIE Automotive to regional powerhouses like Martinrea International and Adient. These companies employ a variety of strategies to maintain their market share and gain an edge. Some key strategies include:

- Geographic Diversification: Expanding into regions with high automotive production growth, such as Asia-Pacific and Eastern Europe, to capture new market opportunities.

- Technological Innovation: Investing in research and development of advanced stamping techniques, high-strength materials, and automation solutions to improve efficiency, reduce costs, and cater to evolving vehicle requirements.

- Vertical Integration: Strengthening control over the supply chain by acquiring or partnering with metal suppliers, tool and die manufacturers, and downstream assembly companies.

- Customer Focus: Building strong relationships with automakers and Tier 1 suppliers by offering customized solutions, on-time delivery, and superior quality control.

Market Share Analysis:

Several factors influence market share analysis in the automotive stamping market. These include:

- Production Volume: Companies with a larger production capacity and ability to cater to high-volume vehicle platforms tend to hold a larger market share.

- Geographic Presence: Companies with a strong presence in regions with significant automotive production hold an advantage.

- Product Portfolio: Offering a diverse range of stamped components, catering to different vehicle segments and applications, broadens market reach.

- Cost Competitiveness: Efficient production processes, strategic sourcing of materials, and cost-effective technology adoption play a crucial role.

- Customer Relationships: Strong partnerships and long-term contracts with major automakers provide a stable revenue stream and market share dominance.

New and Emerging Trends:

The automotive stamping market is witnessing several exciting trends that are shaping the competitive landscape:

- Lightweighting: The increasing focus on fuel efficiency and emission regulations is driving demand for lighter-weight stamped components made from high-strength steels and aluminum alloys.

- Electric Vehicles (EVs): The growing popularity of EVs is creating new opportunities for stamping companies to develop components for battery enclosures, chassis parts, and structural elements.

- Additive Manufacturing (3D Printing): This technology is beginning to make inroads into the stamping market, offering possibilities for rapid prototyping, customization, and production of complex geometries.

- Sustainability: Companies are increasingly adopting sustainable practices, such as using recycled materials, reducing energy consumption, and implementing eco-friendly manufacturing processes.

Overall Competitive Scenario:

The automotive stamping market is expected to witness continued growth in the coming years, driven by factors like increasing vehicle production, technological advancements, and regional expansion. However, the competition is expected to intensify, with established players facing challenges from emerging players and disruptive technologies. Companies that can adapt to these trends, prioritize innovation, and offer cost-effective solutions will be well-positioned to succeed in this dynamic market.

The competitive landscape of the automotive stamping market is a complex and ever-evolving one. Understanding the key players, their strategies, and the market share dynamics is crucial for companies seeking to navigate this space effectively. By embracing new trends, focusing on innovation, and forging strong customer partnerships, companies can secure their position in this vital segment of the automotive industry.

Latest Company Updates:

Talan Products Inc.

- October 2023: Successfully implemented a new ERP system to improve inventory management and production planning. (Source: Talan website)

Eigen:

- October 2023: Announced partnership with Siemens for implementing digital twin technology to optimize stamping processes and predict maintenance needs. (Source: Eigen press release)

WIEGEL TOOL WORKS, INC.

- November 2023: Launched a new line of high-speed presses for improved production rates and reduced cycle times. (Source: WTW website)

Rite International, Inc.

- November 2023: Partnered with a university to develop next-generation stamping dies with improved wear resistance. (Source: Rite International press release)