Increasing Focus on Fuel Efficiency

The Automotive Relay Market is also being propelled by an increasing focus on fuel efficiency among automakers. As regulatory standards for emissions become more stringent, manufacturers are compelled to develop vehicles that consume less fuel and produce fewer emissions. Automotive relays play a vital role in optimizing engine performance and managing various electrical systems that contribute to fuel efficiency. Recent statistics indicate that the automotive fuel efficiency market is on an upward trajectory, which suggests a corresponding rise in the demand for relays that support these initiatives. Thus, the Automotive Relay Market is likely to expand as manufacturers seek to enhance vehicle efficiency through advanced relay technologies.

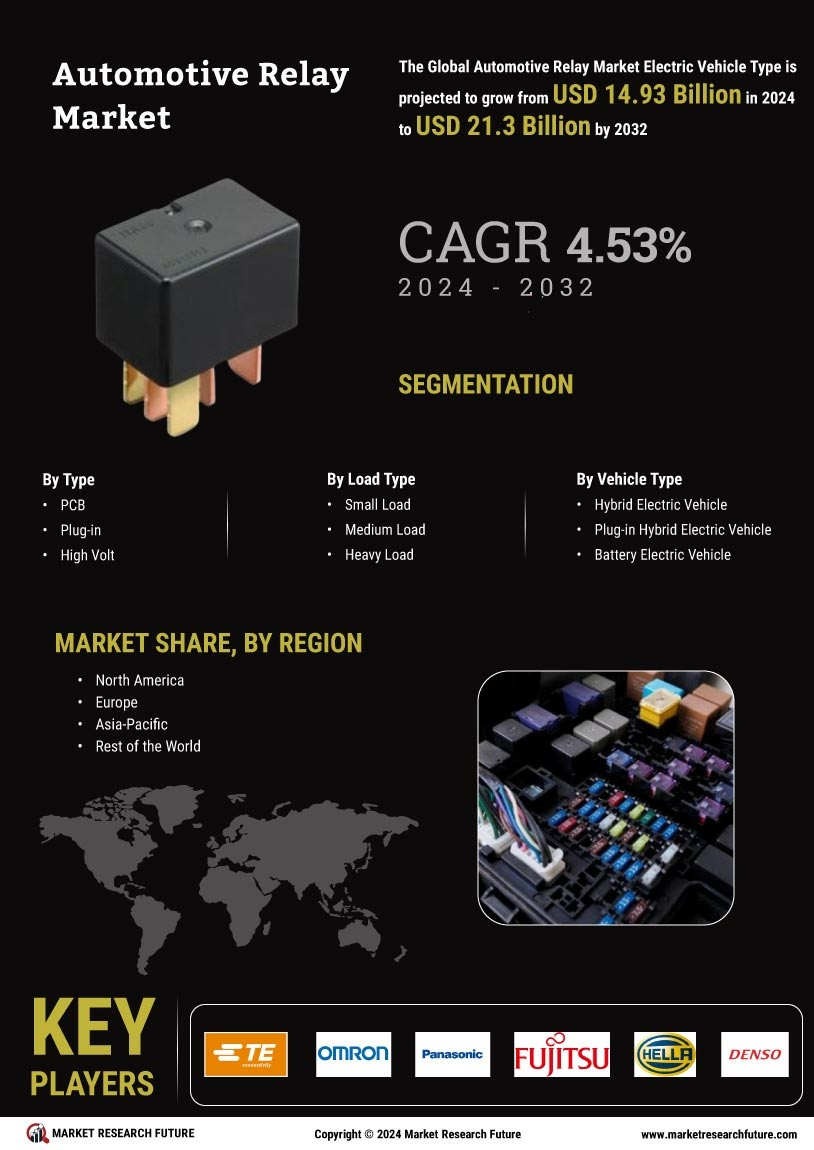

Growth of Electric Vehicle Production

The Automotive Relay Market is poised for growth due to the rising production of electric vehicles (EVs). As the automotive sector shifts towards electrification, the demand for specialized relays that manage high-voltage systems and battery management becomes critical. Data suggests that the electric vehicle market is expected to witness substantial growth, with projections indicating a compound annual growth rate that could exceed 20% over the next few years. This transition necessitates the use of advanced automotive relays, which are essential for the efficient operation of EVs. Consequently, the Automotive Relay Market is likely to benefit from this shift, as manufacturers seek to develop relays that meet the unique requirements of electric vehicles.

Expansion of Automotive Electronics Market

The Automotive Relay Market is benefiting from the overall expansion of the automotive electronics market. As vehicles become increasingly equipped with electronic components, the reliance on automotive relays to manage these systems grows. The automotive electronics market is projected to experience significant growth, driven by trends such as connectivity, infotainment, and advanced driver-assistance systems (ADAS). This expansion creates a favorable environment for the Automotive Relay Market, as manufacturers strive to meet the rising demand for reliable and efficient relays that can support complex electronic architectures. Consequently, the Automotive Relay Market is likely to see enhanced opportunities for growth as the integration of electronics in vehicles continues to evolve.

Rising Demand for Advanced Safety Features

The Automotive Relay Market is experiencing a notable surge in demand for advanced safety features in vehicles. As consumers increasingly prioritize safety, manufacturers are integrating sophisticated electronic systems that rely heavily on automotive relays. These relays play a crucial role in controlling various safety mechanisms, such as airbags and anti-lock braking systems. According to recent data, the automotive safety systems market is projected to grow significantly, which in turn drives the need for reliable automotive relays. This trend indicates that the Automotive Relay Market is likely to expand as automakers invest in technologies that enhance vehicle safety, thereby creating a robust demand for high-quality relays.

Technological Advancements in Relay Design

The Automotive Relay Market is significantly influenced by ongoing technological advancements in relay design. Innovations such as miniaturization, enhanced durability, and improved performance characteristics are driving the development of next-generation automotive relays. These advancements enable manufacturers to produce relays that can withstand harsh automotive environments while providing reliable performance. Furthermore, the integration of smart technologies into relay systems is becoming increasingly common, allowing for better control and monitoring of vehicle functions. As a result, the Automotive Relay Market is likely to see an influx of new products that cater to the evolving needs of automakers, thereby fostering competitive growth.