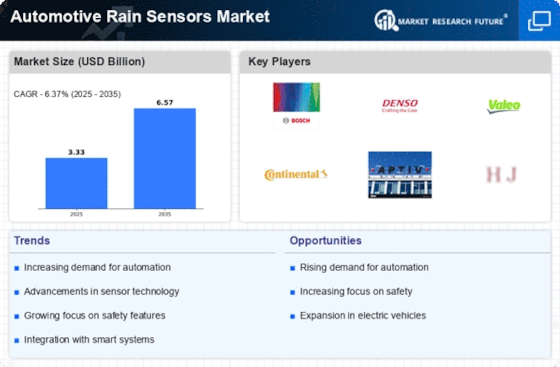

Increasing Vehicle Production and Sales

The Automotive Rain Sensors Market is closely linked to the overall growth in vehicle production and sales. As automotive manufacturers ramp up production to meet rising consumer demand, the integration of rain sensors is becoming more commonplace. Market data indicates that global vehicle production is expected to rise steadily, driven by factors such as urbanization and increasing disposable incomes. This trend suggests that more vehicles equipped with rain sensors will enter the market, thereby expanding the Automotive Rain Sensors Market. Additionally, as manufacturers seek to differentiate their products, the inclusion of rain sensors is likely to become a standard feature in many new models.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Automotive Rain Sensors Market. Governments and regulatory bodies are implementing stringent safety regulations that require vehicles to be equipped with advanced safety features, including rain sensors. This regulatory push is compelling manufacturers to adopt rain sensor technology to ensure compliance and enhance vehicle safety. As a result, the Automotive Rain Sensors Market is expected to benefit from this trend, as more manufacturers integrate rain sensors into their designs to meet these evolving standards. The alignment of market offerings with regulatory requirements is likely to drive growth and innovation within the industry.

Technological Innovations in Sensor Technology

Technological innovations in sensor technology are significantly shaping the Automotive Rain Sensors Market. The development of more sensitive and accurate rain sensors has led to improved performance and reliability, which are critical for consumer acceptance. Innovations such as optical sensors and advanced algorithms for detecting rain intensity are becoming increasingly prevalent. These advancements not only enhance the functionality of rain sensors but also contribute to the overall efficiency of vehicle systems. As manufacturers continue to invest in research and development, the Automotive Rain Sensors Market is poised for growth, with new technologies likely to attract both consumers and automotive manufacturers alike.

Rising Demand for Advanced Driver Assistance Systems

The Automotive Rain Sensors Market is experiencing a notable surge in demand for advanced driver assistance systems (ADAS). As consumers increasingly prioritize safety and convenience, automakers are integrating rain sensors into their vehicles to enhance visibility during adverse weather conditions. This integration not only improves driving safety but also aligns with regulatory requirements for vehicle safety features. According to industry estimates, the ADAS market is projected to grow significantly, with rain sensors playing a crucial role in this expansion. The incorporation of rain sensors into ADAS is likely to drive innovation and competition among manufacturers, further propelling the Automotive Rain Sensors Market.

Growing Consumer Awareness of Vehicle Safety Features

Consumer awareness regarding vehicle safety features is on the rise, significantly impacting the Automotive Rain Sensors Market. As potential buyers become more informed about the benefits of advanced safety technologies, the demand for vehicles equipped with rain sensors is expected to increase. This heightened awareness is driven by various factors, including media coverage of vehicle safety ratings and the influence of social media. Consequently, manufacturers are compelled to enhance their offerings, integrating rain sensors to meet consumer expectations. Market data suggests that vehicles with advanced safety features, including rain sensors, are likely to command higher prices, thereby influencing the overall growth of the Automotive Rain Sensors Market.