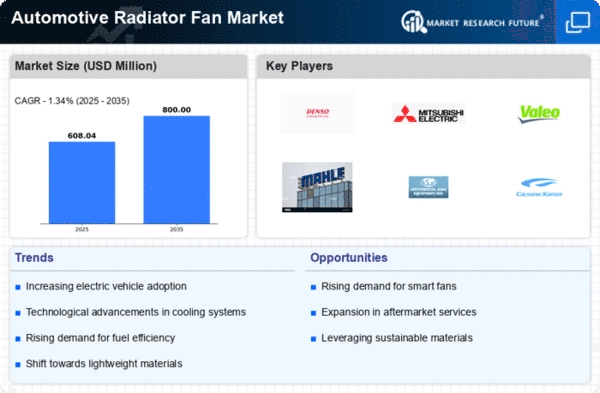

Market Growth Projections

The Automotive Radiator Fan Market is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 5.3% from 2025 to 2035. This growth trajectory is driven by various factors, including increasing vehicle production, technological advancements, and the rising demand for electric vehicles. The market is anticipated to expand from 8.18 USD Billion in 2024 to 14.4 USD Billion by 2035, highlighting the potential for investment and innovation within the industry. This driver encapsulates the overall market dynamics and the opportunities that lie ahead for stakeholders.

Rising Vehicle Production

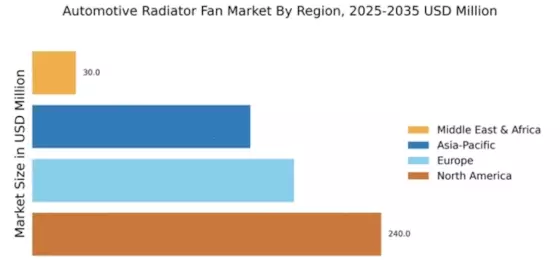

The Vehicle Radiator Fan Market is experiencing growth driven by the increasing production of vehicles worldwide. In 2024, the market is projected to reach 8.18 USD Billion, reflecting the heightened demand for efficient cooling systems in modern automobiles. As manufacturers focus on enhancing vehicle performance and fuel efficiency, the integration of advanced radiator fan technologies becomes crucial. This trend is particularly evident in regions such as Asia-Pacific, where automotive production is surging, leading to a corresponding rise in the need for reliable radiator fans. Consequently, this driver significantly influences the market dynamics and growth trajectory.

Technological Advancements

Technological innovations in automotive cooling systems are propelling the Auto Cooling Fan Market forward. The introduction of electric and variable speed radiator fans enhances energy efficiency and performance, aligning with the automotive industry's shift towards sustainability. These advancements not only improve vehicle performance but also contribute to reduced emissions, appealing to environmentally conscious consumers. As automakers increasingly adopt these technologies, the market is expected to expand, with projections indicating a growth to 14.4 USD Billion by 2035. This driver underscores the importance of innovation in maintaining competitive advantage within the industry.

Increased Aftermarket Opportunities

The Automotive Engine Cooling Fan Industry is witnessing a surge in aftermarket opportunities, driven by the growing vehicle population and the need for replacement parts. As vehicles age, the demand for efficient radiator fans in the aftermarket segment is rising, providing manufacturers with a lucrative avenue for growth. This trend is particularly pronounced in regions with a high density of older vehicles, where maintenance and replacement of cooling systems become essential. The aftermarket segment is expected to contribute significantly to the overall market growth, reflecting the evolving dynamics of consumer behavior and vehicle maintenance practices.

Regulatory Compliance and Standards

Regulatory frameworks aimed at improving vehicle emissions and fuel efficiency are shaping the Automotive Radiator Fan Sector. Stricter regulations compel manufacturers to adopt advanced cooling technologies that comply with environmental standards. This compliance not only enhances vehicle performance but also mitigates environmental impact, aligning with global sustainability goals. As a result, manufacturers are increasingly investing in innovative radiator fan solutions to meet these regulatory demands. This driver is likely to play a crucial role in shaping market strategies and product development in the automotive sector.

Growing Demand for Electric Vehicles

The transition towards electric vehicles (EVs) is a pivotal driver for the Automotive Radiator Fan Industry. As EV adoption accelerates, the need for efficient thermal management systems, including radiator fans, becomes paramount. Electric vehicles require specialized cooling solutions to maintain optimal battery temperatures, thereby enhancing performance and longevity. This trend is supported by government initiatives promoting EV adoption, which further stimulates market growth. The increasing focus on sustainability and reduced carbon footprints positions this driver as a significant factor influencing the market landscape in the coming years.