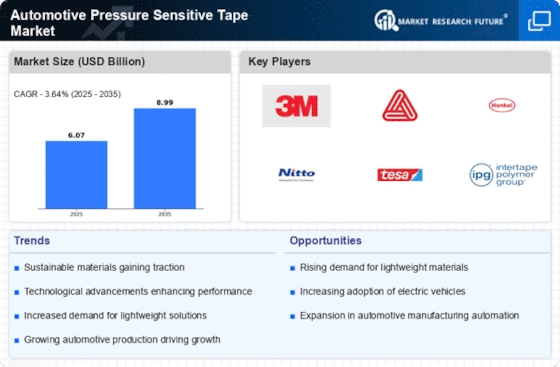

Growth of Electric Vehicle Production

The surge in electric vehicle (EV) production is a pivotal driver for the Automotive Pressure Sensitive Tape Market. As automakers transition to electric models, the need for efficient assembly processes and lightweight components becomes paramount. Pressure sensitive tapes are utilized in various applications, including battery assembly and interior fittings, which are critical for EVs. Reports indicate that the EV market is expected to witness a compound annual growth rate of over 20% in the coming years, suggesting a substantial increase in demand for specialized automotive tapes that cater to this evolving sector.

Increased Focus on Vehicle Aesthetics

The automotive sector is placing greater emphasis on aesthetics and design, which is influencing the Automotive Pressure Sensitive Tape Market. Manufacturers are utilizing pressure sensitive tapes for decorative applications, such as trim and molding, to enhance the visual appeal of vehicles. This trend is particularly evident in premium and luxury segments, where consumers are willing to pay a premium for superior design. As the market for automotive aesthetics continues to expand, the demand for high-quality pressure sensitive tapes that offer both functionality and visual enhancement is likely to rise, further driving market growth.

Rising Demand for Lightweight Materials

The automotive industry is increasingly shifting towards lightweight materials to enhance fuel efficiency and reduce emissions. This trend is driving the Automotive Pressure Sensitive Tape Market, as these tapes are essential for bonding lightweight components without adding significant weight. The demand for lightweight vehicles is projected to grow, with estimates suggesting that the market for lightweight materials could reach several billion dollars by 2026. Consequently, manufacturers are likely to invest in advanced pressure-sensitive tapes that can meet the stringent requirements of modern automotive designs, thereby propelling the market forward.

Regulatory Compliance and Safety Standards

Stringent regulatory compliance and safety standards are increasingly shaping the Automotive Pressure Sensitive Tape Market. Governments worldwide are implementing regulations that mandate the use of high-performance materials in vehicle manufacturing to ensure safety and durability. Pressure sensitive tapes are often required in applications that enhance structural integrity and safety features. As regulations evolve, manufacturers are compelled to adopt advanced adhesive technologies that meet these standards, potentially leading to an uptick in demand for specialized automotive tapes that comply with safety regulations, thereby fostering market expansion.

Technological Innovations in Adhesive Solutions

Technological innovations in adhesive solutions are significantly impacting the Automotive Pressure Sensitive Tape Market. Advances in adhesive formulations and application techniques are enabling the development of tapes that offer superior bonding strength, temperature resistance, and durability. These innovations are crucial as automotive manufacturers seek to improve production efficiency and product longevity. The market for advanced adhesive solutions is projected to grow, with estimates indicating a potential increase in value by several billion dollars over the next few years. This trend suggests that the Automotive Pressure Sensitive Tape Market will benefit from ongoing research and development efforts aimed at enhancing adhesive performance.