Rising Demand for Electric Vehicles

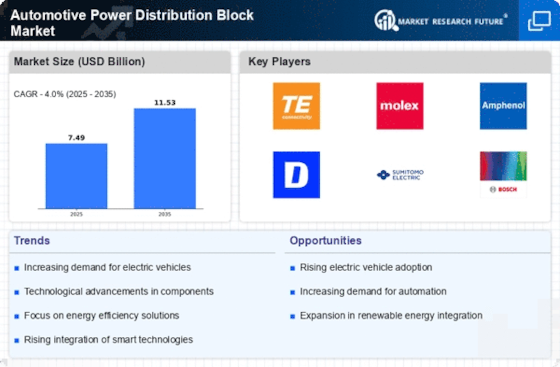

The increasing adoption of electric vehicles (EVs) is a primary driver for the Automotive Power Distribution Block Market. As consumers and manufacturers shift towards sustainable transportation solutions, the need for efficient power distribution systems becomes paramount. In 2025, the EV market is projected to grow significantly, with estimates suggesting that EV sales could reach over 30 million units annually. This surge necessitates advanced power distribution blocks that can manage the complex electrical systems inherent in EVs, ensuring optimal performance and safety. Consequently, manufacturers are focusing on developing innovative power distribution solutions tailored to the unique requirements of electric drivetrains, thereby propelling the Automotive Power Distribution Block Market forward.

Growth of Autonomous Vehicle Technology

The growth of autonomous vehicle technology is emerging as a significant driver for the Automotive Power Distribution Block Market. As vehicles become increasingly automated, the complexity of their electrical systems escalates, necessitating advanced power distribution solutions. Autonomous vehicles rely on a multitude of sensors, cameras, and computing systems, all of which require efficient power management. The market for autonomous vehicles is projected to reach a valuation of over 60 billion by 2025, indicating a substantial opportunity for power distribution block manufacturers. This trend compels industry players to develop innovative solutions that can support the high power demands of autonomous systems, thereby fostering growth in the power distribution block sector.

Regulatory Push for Emission Reductions

Regulatory frameworks aimed at reducing emissions are significantly influencing the Automotive Power Distribution Block Market. Governments worldwide are implementing stringent emission standards, compelling automakers to adopt cleaner technologies. This regulatory push is particularly evident in the transition towards electric and hybrid vehicles, which require advanced power distribution systems to manage their unique electrical demands. As a result, the market for power distribution blocks is expected to expand, with projections indicating a potential increase in demand by over 20% in the next five years. Manufacturers are thus incentivized to innovate and produce power distribution solutions that comply with these regulations, ensuring their products remain competitive in a rapidly evolving market.

Increased Focus on Vehicle Safety Features

The heightened focus on vehicle safety features is driving the Automotive Power Distribution Block Market. As consumers prioritize safety in their purchasing decisions, automakers are integrating advanced safety technologies into their vehicles. These technologies, such as collision avoidance systems and advanced driver-assistance systems (ADAS), require reliable power distribution systems to function effectively. The market for automotive safety systems is expected to grow at a CAGR of around 8% through 2025, reflecting the increasing investment in safety features. Consequently, the demand for power distribution blocks that can support these systems is likely to rise, prompting manufacturers to enhance their offerings to meet the evolving safety standards and consumer expectations.

Technological Advancements in Automotive Electronics

Technological advancements in automotive electronics are reshaping the Automotive Power Distribution Block Market. Innovations such as smart power distribution systems, which integrate real-time monitoring and diagnostics, are becoming increasingly prevalent. These systems enhance vehicle performance and reliability, addressing the growing consumer demand for advanced features. The market for automotive electronics is expected to witness a compound annual growth rate (CAGR) of approximately 7% through 2025, indicating a robust expansion. As vehicles become more electrified and automated, the need for sophisticated power distribution blocks that can support these technologies is likely to increase, driving market growth and encouraging manufacturers to invest in research and development.