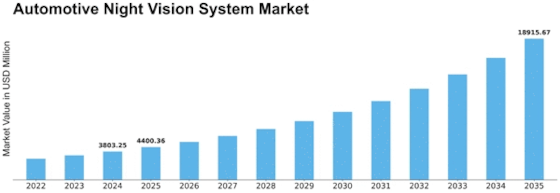

Automotive Night Vision System Size

Automotive Night Vision System Market Growth Projections and Opportunities

The market for automotive night vision systems is driven by a number of key drivers that make an important contribution to the development and growth in this particular niche. A key aspect is the growing attention to road safety. Road accidents are a global problem, and both governments and consumers seek to implement cutting-edge technologies to improve vehicle safety. The auto night vision system that allows people to see pedestrians, animals and obstacles in the darkness has become widely known as an effective safety element. And technological innovations also add to the dynamics of the automotive night vision system market. With the advancements in research and development of cars, better night vision systems are developed utilizing leading technologies including IR detectors as well as thermal imaging. These technological innovations do not only improve the efficiency of night vision systems but also facilitate their wider use by automakers. The regulatory landscape is another important factor in the automotive night vision system market that impacts it. In addition to government regulations concerning vehicle safety measures standards and ADAS integration, night vision systems adoption is being driven by. In certain areas, regulatory agencies are actively encouraging the adoption of safety technologies in vehicles which makes conducive an environment paving way for automotive night vision system market. The market dynamics are, however also significantly influenced by consumer awareness and preferences. With consumers being increasingly aware of safety features, there is an increasing demand for vehicles with safer technologies such as the night vision systems. Vehicle manufacturers are meeting this need by incorporating night vision systems into their car models, contributing to the growth of the market. In addition, the automotive night vision system market is heavily influenced by overall trends in the automotive industry. The surge in the production of higher quality premium and high-end vehicles has also contributed to growing market demand, as several such cars come with night vision systems. Furthermore, the increasing popularity of electric and autonomous cars creates additional space for night vision systems application since these vehicles are using cutting-edge technology to provide better security and driving quality. The automotive night vision system market is also driven by economic factors. Consumer’s level of disposable income determines their spending capacity as well as their propensity to acquire vehicles fitted with highly sophisticated safety applications. Economic stability and growth increase the favorable market conditions where it encourages more people to adopt night vision systems.

Leave a Comment