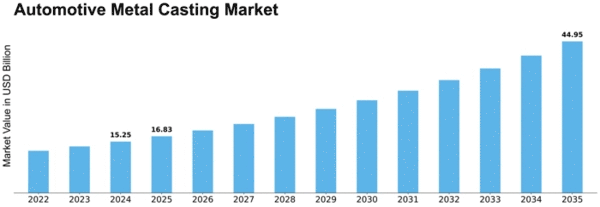

Automotive Metal Casting Size

Automotive Metal Casting Market Growth Projections and Opportunities

The automotive metal casting market is influenced by various market factors that play a crucial role in its growth and development. One significant factor is the demand for automobiles. As the automotive industry experiences fluctuations in demand for vehicles, it directly impacts the demand for metal castings used in the manufacturing process. Factors such as consumer preferences, economic conditions, and government policies affect the demand for automobiles, consequently affecting the automotive metal casting market.

Automotive metal casting market has witnessed a significant surge, mainly, due to the current hype regarding mobility services, autonomous driving, digitization and electric powertrains dominating the automotive industry.

Moreover, technological advancements play a pivotal role in shaping the automotive metal casting market. Innovations in casting processes, materials, and equipment enhance the efficiency and quality of metal castings, making them more desirable for automotive manufacturers. For instance, advancements in computer-aided design (CAD) and simulation technologies enable manufacturers to optimize casting designs and minimize defects, thus improving overall product quality.

Furthermore, raw material prices and availability significantly impact the automotive metal casting market. Metals such as aluminum, iron, and steel are primary materials used in casting processes. Fluctuations in the prices of these raw materials, as influenced by factors like mining regulations, geopolitical tensions, and market demand, directly affect the production costs of metal castings. Additionally, the availability of these raw materials can be constrained by factors such as supply chain disruptions or resource depletion, posing challenges for automotive casting manufacturers.

Another market factor influencing the automotive metal casting industry is environmental regulations and sustainability initiatives. Governments worldwide are implementing stringent emissions standards and promoting sustainable manufacturing practices to mitigate environmental impact. As a result, automotive manufacturers are increasingly opting for lightweight materials like aluminum and magnesium, which offer better fuel efficiency and reduced emissions compared to traditional materials like iron and steel. This shift towards lightweighting in the automotive industry creates opportunities for metal casting manufacturers specializing in these materials.

Furthermore, market competition plays a crucial role in shaping the dynamics of the automotive metal casting industry. With a growing number of players in the market, competition intensifies, leading to innovations, cost reductions, and improved product quality. Additionally, factors such as globalization and trade agreements influence market competition by enabling companies to expand their presence in new markets and access a broader customer base.

Moreover, the automotive metal casting market is influenced by trends in vehicle design and manufacturing. As automotive manufacturers strive to meet consumer demands for fuel efficiency, safety, and performance, they continuously innovate in vehicle design and incorporate advanced technologies. This includes the integration of complex metal cast components in modern vehicle designs, such as engine blocks, transmission housings, and suspension components. Consequently, automotive metal casting manufacturers must stay abreast of these trends to align their product offerings with evolving industry requirements.

Leave a Comment