Market Analysis

In-depth Analysis of Automotive Metal Casting Market Industry Landscape

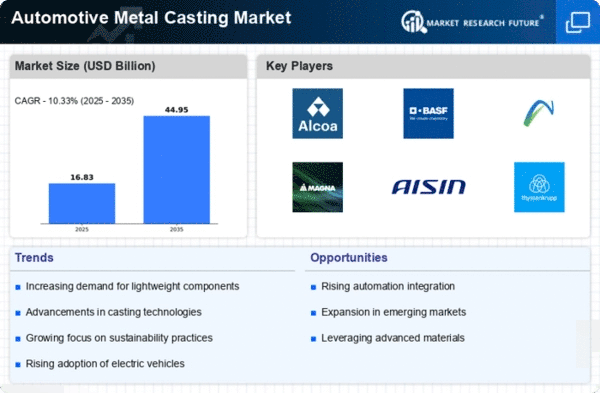

The automotive metal casting market operates within the broader automotive industry, playing a crucial role in providing components for vehicles. Market dynamics in this sector are influenced by various factors that impact demand, supply, and competition. One significant driver of market dynamics is the overall growth and health of the automotive industry. When the automotive sector experiences growth, there's typically an increased demand for metal castings to produce various components such as engine parts, transmission components, and structural elements. Conversely, during periods of economic downturn or reduced consumer spending on vehicles, demand for automotive metal castings may decrease.

Fluctuating cost of metals is expected to be a major retraining factor in the automotive metal casting market. The increasing demand for steel is directly proportional to the increasing demand for automobiles, across the globe.

Technological advancements also shape the market dynamics of automotive metal casting. Innovations in casting processes, materials, and design technologies can lead to improved efficiency, cost-effectiveness, and performance of metal castings. For instance, the adoption of advanced simulation and modeling techniques allows manufacturers to optimize casting designs, reduce defects, and enhance overall quality. Additionally, the development of lightweight materials and alloys helps automotive manufacturers meet stringent fuel efficiency and emissions regulations, driving the demand for specialized metal castings.

Globalization plays a significant role in shaping the market dynamics of automotive metal casting. The industry is heavily influenced by international trade patterns, with manufacturers sourcing components and materials from various regions to remain competitive. Factors such as tariffs, trade agreements, and geopolitical tensions can impact the cost and availability of metal castings, leading to fluctuations in market dynamics. Furthermore, the emergence of new manufacturing hubs and the relocation of production facilities to low-cost regions affect the competitive landscape and supply chain dynamics in the automotive metal casting market.

Environmental regulations and sustainability initiatives are increasingly influencing market dynamics in the automotive metal casting sector. As governments worldwide impose stricter emissions standards and encourage the adoption of eco-friendly technologies, automotive manufacturers are under pressure to reduce the environmental impact of their production processes. This trend has led to the development of cleaner and more energy-efficient casting methods, as well as the recycling and reuse of casting materials to minimize waste and resource consumption. Companies that demonstrate a commitment to sustainability may gain a competitive advantage and access new market opportunities driven by environmentally conscious consumers and regulatory requirements.

Supply chain disruptions, such as raw material shortages, transportation bottlenecks, and natural disasters, can significantly impact the market dynamics of automotive metal casting. These disruptions can lead to supply shortages, production delays, and increased costs for manufacturers, affecting their ability to meet customer demand and maintain profitability. To mitigate these risks, companies often implement strategies such as diversifying their supplier base, investing in inventory management systems, and establishing contingency plans to respond effectively to unexpected events.

Leave a Comment