- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

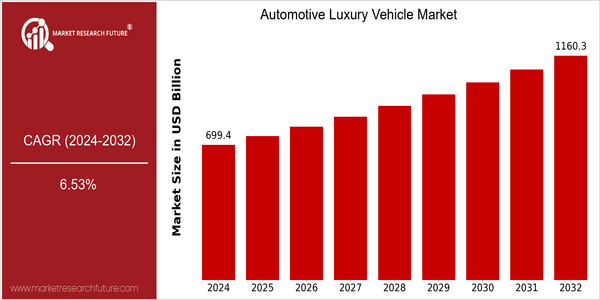

| Year | Value |

|---|---|

| 2024 | USD 699.38 Billion |

| 2032 | USD 1160.3 Billion |

| CAGR (2024-2032) | 6.53 % |

Note – Market size depicts the revenue generated over the financial year

The luxury car market is expected to grow at a CAGR of 4.6% from 2016 to 2024, and reach $1,603,080,000 by 2032. This is a robust CAGR of 6.53% during the forecast period. This is due to the rising trend of the number of people who want to buy premium vehicles. With the rise in the number of people with high incomes and the increase in the number of cities, the demand for luxury cars will increase. The electric vehicle and the self-driving car will also change the luxury car industry, and will attract a new generation of consumers who value innovation and environmentalism. The major players in the industry, such as Mercedes-Benz, BMW, and Tesla, are constantly investing in research and development, forming strategic alliances, and launching new products to meet the new needs of consumers. The industry's top players, such as Tesla's expansion into the luxury EV market and the commitment of BMW to the electrification of its entire product line, have already realized the trend of the market and have laid a solid foundation for future growth.

Regional Market Size

Regional Deep Dive

The Automotive Luxury Vehicles Market is characterized by a dynamic interplay of consumer preferences, technological advancements, and economic factors across different regions. North America is characterized by a strong demand for high-end vehicles, with consumers placing a higher emphasis on luxury features and sustainable products. The European region showcases a strong heritage of luxury car brands, with a strong focus on innovation and government regulations. The Asia-Pacific region is characterized by a growing demand for luxury vehicles, with rising disposable incomes and an expanding middle class eager to purchase luxury vehicles. Middle East and Africa offer unique opportunities for luxury vehicle manufacturers, with a high concentration of wealth and a growing appetite for luxury goods. Latin America, although a developing region, has witnessed a gradual rise in the sale of luxury vehicles, with the economy improving and consumer preferences shifting towards premium offerings.

Europe

- European luxury brands are increasingly focusing on sustainability, with initiatives like the European Union's Green Deal encouraging manufacturers such as Audi and Porsche to enhance their electric vehicle lineups.

- The introduction of advanced driver-assistance systems (ADAS) is becoming a standard feature in luxury vehicles, with companies like BMW and Mercedes-Benz investing heavily in autonomous driving technologies.

Asia Pacific

- China remains a key player in the luxury vehicle market, with brands like NIO and Xpeng gaining traction alongside established players like Audi and BMW, reflecting a shift towards homegrown luxury brands.

- Government incentives for electric vehicles are driving growth, with initiatives such as subsidies and tax breaks encouraging consumers to opt for luxury EVs, significantly impacting market dynamics.

Latin America

- The luxury vehicle market is gradually expanding in Latin America, with Brazil and Mexico leading the way, as economic growth and a rising affluent class drive demand for premium vehicles.

- Brands like Land Rover and Mercedes-Benz are increasing their presence in the region, adapting their marketing strategies to cater to local tastes and preferences.

North America

- The rise of electric luxury vehicles is notable, with companies like Tesla and Lucid Motors leading the charge, prompting traditional luxury brands such as Mercedes-Benz and BMW to accelerate their EV offerings.

- Regulatory changes, particularly in California, are pushing for stricter emissions standards, which is influencing luxury automakers to invest more in sustainable technologies and hybrid models.

Middle East And Africa

- The luxury vehicle market in the Middle East is heavily influenced by oil wealth, with brands like Rolls-Royce and Bentley seeing strong demand, particularly in the UAE and Saudi Arabia.

- Cultural factors, such as a preference for high-performance vehicles, are shaping the market, with local events like the Dubai International Motor Show showcasing the latest luxury offerings.

Did You Know?

“Did you know that the luxury vehicle market is projected to see a significant increase in electric vehicle offerings, with estimates suggesting that by 2025, nearly 30% of luxury car sales in Europe will be electric?” — European Automobile Manufacturers Association (ACEA)

Segmental Market Size

The Luxury Vehicle Market is a fast-growing market, driven by a growing demand for premium features and enhanced driving experiences. The trend towards personalization and advanced technology integration is also a major driver for this market. Also, a growing emphasis on sustainability is driving manufacturers to develop electric luxury vehicles. Also, government regulations to reduce emissions are pushing luxury brands to adopt greener technology. In the current scenario, the market is a mature one, with companies like Mercedes-Benz, BMW, and Tesla leading the way in electric luxury vehicles. The luxury vehicle market is dominated by the North American and European regions. The most prominent applications of luxury vehicle technology include high-speed electric vehicles, self-driving features, and connected-car systems. Examples of these include the AutoPilot feature in the Tesla and the iDrive feature in the BMW. The most important trends in the market include a growing emphasis on electric vehicles, the development of artificial intelligence, and the rise of connected-car technology. These trends are shaping the future of luxury vehicles.

Future Outlook

The Luxury Cars Market is expected to grow at a CAGR of 6.53% from 2024 to 2032, from $ 699.38 billion to $1,160.3 billion. Rising incomes in emerging markets, coupled with the increasing desire for premium features and experiences, will drive this growth. By 2032, luxury vehicles are expected to account for more than 20 percent of the total vehicle sales. The development of electric and driverless vehicles, and the implementation of digital services, will be the most important technological trends in shaping the luxury vehicle market. The luxury vehicle industry will be a leader in these technological innovations, offering consumers not only enhanced performance, but also greater efficiency and lower emissions. Government support for electric vehicles and the imposition of stricter emissions standards will also push luxury car manufacturers to invest in electric and driverless vehicles. The integration of high-tech features and the development of digital services will also change the way consumers engage with the luxury vehicle market, ensuring that the market remains dynamic and responsive to changing customer preferences.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 605.2 Billion |

| Market Size Value In 2023 | USD 650.59 Billion |

| Growth Rate | 7.50% (2023-2032) |

Automotive Luxury Vehicle Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.