· Mineral Oil

· Synthetic Oil

· Semi-synthetic Oil

· Bio-Based Oil

· Engine Oil

· Gear Oil

· Grease

· Coolants / Antifreeze Fluids

· Brake Fluids

· Others

Automotive Lubricants Sales Channel Outlook (USD Million, 2019-2035)

· OEMs

· Aftermarket

Automotive Lubricants End User Outlook (USD Million, 2019-2035)

· Passenger Cars

· Light Commercial Vehicles (LCVs)

· Heavy Commercial Vehicles (HCVs)

· Two-Wheelers / Motorcycles

· Battery Electric Vehicles

· Others

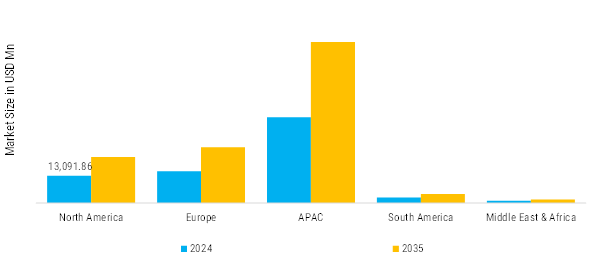

Automotive Lubricants Regional Outlook (USD Million, 2019-2035)

· North America Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o US Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Canada Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

· Europe Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Germany Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o UK Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o France Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Russia Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Italy Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Spain Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Rest Of Europe Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

· Asia-Pacific Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o China Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o India Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Japan Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o South Korea Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Rest of Asia-Pacific Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

· South America Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Mexico Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Brazil Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Argentina Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Rest of Latin America Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

· Middle East & Africa Outlook (USD Million, 2019-2035)

o Middle East & Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Middle East & Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Middle East & Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Middle East & Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o GCC Countries Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o South Africa Outlook (USD Million, 2019-2035)

o Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

o Rest of Middle East & Africa Outlook (USD Million, 2019-2035)

o Rest of Middle East & Automotive Lubricants Market by Base Oil

§ Mineral Oil

§ Synthetic Oil

§ Semi-synthetic Oil

§ Bio-Based Oil

o Rest of Middle East & Automotive Lubricants Market by Product Type

§ Engine Oil

§ Gear Oil

§ Grease

§ Coolants / Antifreeze Fluids

§ Brake Fluids

§ Others

o Rest of Middle East & Automotive Lubricants Market by Sales Channel

§ OEMs

§ Aftermarket

o Rest of Middle East & Automotive Lubricants Market by End User

§ Passenger Cars

§ Light Commercial Vehicles (LCVs)

§ Heavy Commercial Vehicles (HCVs)

§ Two-Wheelers / Motorcycles

§ Battery Electric Vehicles

§ Others

Leave a Comment