Economic Incentives

Economic incentives provided by governments are significantly impacting the Automotive Low Emission Vehicle Market. Many countries offer tax credits, rebates, and grants to encourage the purchase of low-emission vehicles. For example, in the United States, federal tax credits for electric vehicles can reach up to $7,500, making them more financially attractive to consumers. These incentives not only lower the initial cost of low-emission vehicles but also stimulate demand, thereby encouraging manufacturers to invest in production. As these economic incentives continue to evolve, they are likely to play a crucial role in shaping consumer behavior and driving growth within the Automotive Low Emission Vehicle Market.

Consumer Preferences

Shifting consumer preferences are a driving force in the Automotive Low Emission Vehicle Market. There is a growing awareness among consumers regarding environmental issues, leading to an increased demand for sustainable transportation options. Surveys indicate that a significant percentage of consumers are willing to pay a premium for low-emission vehicles, reflecting a shift in purchasing behavior. This trend is further supported by the rise of eco-conscious brands and marketing strategies that emphasize sustainability. As consumers prioritize eco-friendly options, manufacturers are compelled to align their offerings with these preferences, thereby influencing the overall dynamics of the Automotive Low Emission Vehicle Market.

Regulatory Pressures

The Automotive Low Emission Vehicle Market is increasingly influenced by stringent regulatory frameworks aimed at reducing greenhouse gas emissions. Governments worldwide are implementing policies that mandate lower emissions from vehicles, which compels manufacturers to innovate and produce low-emission alternatives. For instance, the European Union has set ambitious targets to cut CO2 emissions from new cars by 55% by 2030. Such regulations not only drive compliance costs but also create a competitive landscape where companies that adapt swiftly to these changes can gain market share. The pressure to meet these regulations is likely to accelerate the transition towards electric and hybrid vehicles, thereby shaping the future of the Automotive Low Emission Vehicle Market.

Infrastructure Development

Infrastructure development is a critical driver for the Automotive Low Emission Vehicle Market. The expansion of charging stations and hydrogen refueling stations is essential for supporting the adoption of electric and fuel cell vehicles. Governments and private entities are investing heavily in infrastructure to ensure that consumers have access to the necessary facilities for low-emission vehicles. For instance, the number of public charging stations has been increasing rapidly, with projections indicating a potential doubling in the next few years. This development not only alleviates range anxiety among consumers but also enhances the overall viability of low-emission vehicles, thereby fostering growth in the Automotive Low Emission Vehicle Market.

Technological Advancements

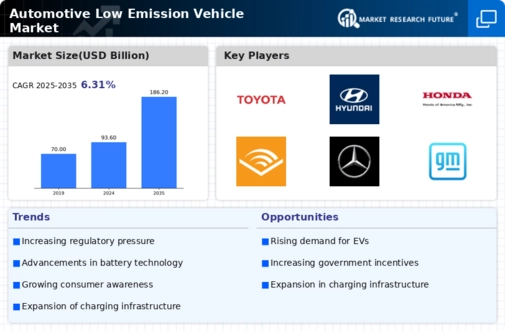

Technological advancements play a pivotal role in shaping the Automotive Low Emission Vehicle Market. Innovations in battery technology, such as solid-state batteries, are enhancing the efficiency and range of electric vehicles, making them more appealing to consumers. Furthermore, advancements in fuel cell technology are providing alternative pathways for low-emission vehicles. According to recent data, The Automotive Low Emission Vehicle Market is projected to grow at a compound annual growth rate of over 20% through 2027. This growth is indicative of the increasing adoption of low-emission technologies, which are becoming more accessible and affordable. As these technologies continue to evolve, they are expected to significantly impact the Automotive Low Emission Vehicle Market.