Automotive Lamps Market Summary

As per Market Research Future analysis, the Automotive Lamps Market Size was estimated at 76610.36 USD Million in 2024. The Automotive Lamps industry is projected to grow from USD 77836.13 Million in 2025 to USD 91225.93 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Automotive Lamps Market is experiencing a transformative shift towards energy-efficient and technologically advanced lighting solutions.

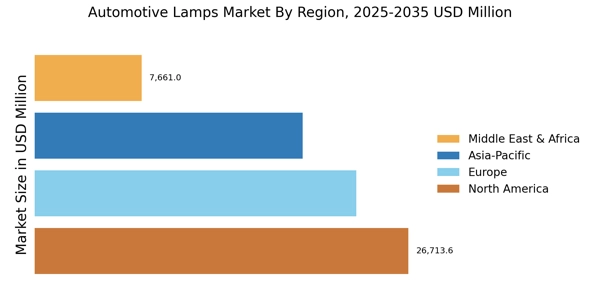

- The market is witnessing a significant shift towards energy-efficient lighting, particularly in North America, which remains the largest market.

- Integration of smart technologies in automotive lamps is becoming increasingly prevalent, especially in the Asia-Pacific region, known for its rapid growth.

- Head lamps continue to dominate the market, while interior lamps are emerging as the fastest-growing segment due to evolving consumer preferences.

- Rising demand for vehicle safety features and technological advancements in lighting solutions are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 76610.36 (USD Million) |

| 2035 Market Size | 91225.93 (USD Million) |

| CAGR (2025 - 2035) | 1.6% |