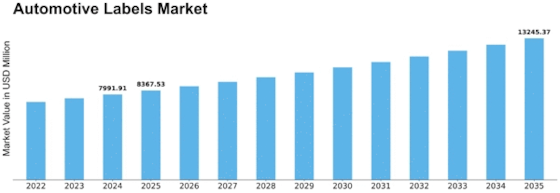

Automotive Labels Size

Automotive Labels Market Growth Projections and Opportunities

The market for automotive labels is changing rapidly due to the growth of car production, tight standards on production, and increasing demand for sophisticated labelling systems. However, one main propeller of this dynamic has been the approaching rise in global vehicle output. As the automotive industry grows, there is an increased demand for various types of labels including branding, safety warnings and compliance labels. This entails that automotive label act as both carriers of essential information and contributors to brand identity as well as regulatory compliance which affects positively how the market behaves. The regulation particularly concerning vehicle safety and emissions has a great role to play in fixing the dynamics of the Automotive Labels market. The regulators worldwide have mandated certain data about vehicles like environmental impacts, safety warnings and origin of components should be presented. This implies that these labels should be sufficiently stiff to meet these requirements. These developments are leading to an increase in demand for advanced labeling solutions that can deliver accurate information throughout the life of a product while still withstanding harsh environmental conditions thereby meaning that it determines how some markets behave. Furthermore, increasing interest in better labeling technologies as well as smart labs define transformations in the Automotive Labels field today. There is a need for different types of tags beyond simple identification purpose as technology becomes much more integrated with vehicles. Smart labels equipped by RFID (Radio-Frequency Identification) tool may help automakers track inventory faster; take measures against forgery; enhance communication between cars and infrastructure among other things. Thus, these new features have altered market dynamics within the automobile sector. Market dynamics relating to Automotive Labels are driven by enhanced emphasis on sustainability and eco-friendly practices. Both automakers and customers are becoming increasingly aware about their environmental footprint hence there is huge demand for these kinds of stickers made from recyclable materials or printed using green technologies only. Changes in behavior follow this development towards greener label solutions observed across industry thus impacting manufacturers’ choices and consumers alike shaping market trends.

Leave a Comment