Automotive Inverter Market Summary

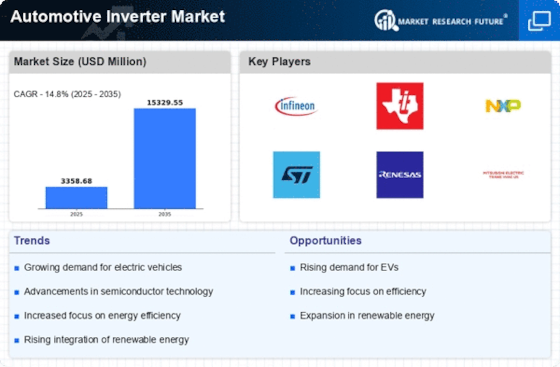

As per Market Research Future analysis, the Automotive Inverter Market Size was estimated at 3358.68 USD Million in 2024. The Automotive Inverter industry is projected to grow from 3855.76 USD Million in 2025 to 15329.55 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 14.8% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Automotive Inverter Market is experiencing robust growth driven by technological advancements and increasing electric vehicle adoption.

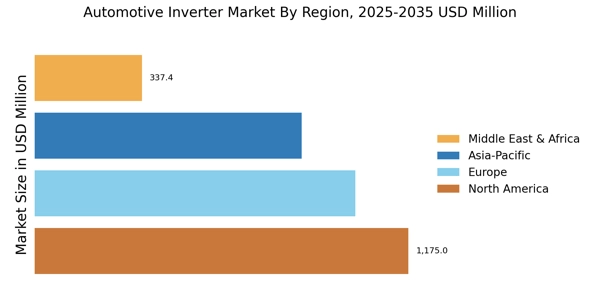

- The rise of electric vehicles is significantly influencing the demand for automotive inverters, particularly in North America.

- Technological advancements in semiconductors are enhancing the efficiency and performance of inverters, fostering innovation.

- Integration of smart technologies is becoming prevalent, especially in traction inverters, which represent the largest segment.

- The increase in electric vehicle adoption and government regulations are key drivers propelling market growth in both North America and Asia-Pacific.

Market Size & Forecast

| 2024 Market Size | 3358.68 (USD Million) |

| 2035 Market Size | 15329.55 (USD Million) |

| CAGR (2025 - 2035) | 14.8% |

Major Players

Infineon Technologies (DE), Texas Instruments (US), NXP Semiconductors (NL), STMicroelectronics (FR), Renesas Electronics (JP), Mitsubishi Electric (JP), Toshiba (JP), Denso Corporation (JP), Continental AG (DE)