Growing Electric Vehicle Adoption

The Automotive Intelligent Lighting System Market is being propelled by the rapid adoption of electric vehicles (EVs). As the automotive landscape shifts towards electrification, manufacturers are increasingly incorporating advanced lighting technologies to enhance the appeal and functionality of EVs. Intelligent lighting systems not only improve visibility but also contribute to energy efficiency, which is a critical consideration for EV owners. Market analysis suggests that the demand for intelligent lighting solutions in electric vehicles is expected to rise significantly, with projections indicating a potential increase of over 20% in the next five years. This trend underscores the importance of intelligent lighting systems in the evolving Automotive Intelligent Lighting System Market.

Integration of Smart Technologies

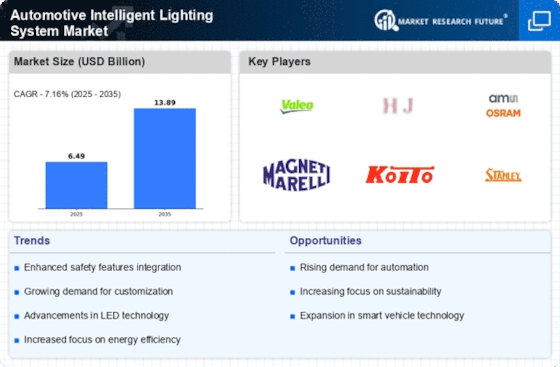

The Automotive Intelligent Lighting System Market is significantly influenced by the integration of smart technologies into vehicles. With the advent of connected cars, lighting systems are evolving to incorporate features such as automatic dimming, obstacle detection, and communication with other vehicles. This integration not only enhances the driving experience but also improves safety by providing real-time information to drivers. Market data indicates that the adoption of smart lighting systems is expected to grow at a compound annual growth rate of over 15% in the coming years. As automakers strive to differentiate their offerings, the incorporation of intelligent lighting solutions is becoming a key focus area within the Automotive Intelligent Lighting System Market.

Regulatory Standards and Compliance

The Automotive Intelligent Lighting System Market is significantly shaped by evolving regulatory standards aimed at improving vehicle safety and environmental impact. Governments worldwide are implementing stringent regulations regarding vehicle lighting systems, necessitating the adoption of advanced technologies that comply with these standards. For instance, regulations mandating the use of adaptive lighting systems are becoming more prevalent, pushing manufacturers to innovate and enhance their offerings. Compliance with these regulations not only ensures safety but also provides a competitive edge in the market. As a result, the Automotive Intelligent Lighting System Market is likely to experience growth as manufacturers adapt to these regulatory changes and invest in compliant lighting technologies.

Consumer Preference for Customization

The Automotive Intelligent Lighting System Market is witnessing a shift in consumer preferences towards personalized vehicle features. Modern consumers are increasingly seeking customization options that allow them to tailor their vehicles to their individual tastes and needs. Intelligent lighting systems offer a range of customizable features, such as color-changing LEDs and programmable lighting patterns, which enhance the aesthetic appeal of vehicles. Recent surveys indicate that nearly 60% of consumers express interest in vehicles with customizable lighting options. This trend is prompting manufacturers to innovate and expand their offerings, thereby driving growth within the Automotive Intelligent Lighting System Market as they cater to the evolving demands of consumers.

Rising Demand for Enhanced Safety Features

The Automotive Intelligent Lighting System Market is experiencing a notable surge in demand for advanced safety features. As consumers become increasingly aware of road safety, manufacturers are integrating intelligent lighting systems that enhance visibility and reduce accidents. According to recent data, vehicles equipped with adaptive lighting systems can reduce nighttime accidents by up to 30%. This growing emphasis on safety is driving automakers to invest in innovative lighting technologies, such as adaptive headlights and dynamic lighting systems, which adjust to road conditions. Consequently, the Automotive Intelligent Lighting System Market is poised for substantial growth as safety becomes a paramount concern for consumers and regulatory bodies alike.