Top Industry Leaders in the Automotive Insurance Market

*Disclaimer: List of key companies in no particular order

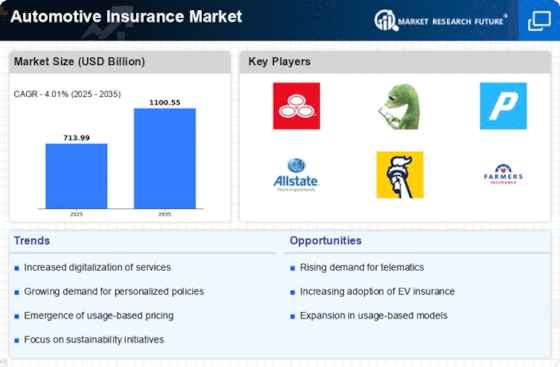

The automotive insurance industry, a colossal entity spanning across continents, is a hotbed of competition where established giants vie for supremacy and agile disruptors navigate the lanes in pursuit of fresh opportunities. To comprehend this dynamic sector, it is imperative to scrutinize the key players, their strategies, and the emerging trends that are shaping the future of this competitive road.

Established Players: Strategies and Dominance

The landscape is dotted with formidable incumbents such as AXA SA Group, GEICO, Liberty Mutual Insurance, Bajaj Allianz, Allstate Insurance Company, The Progressive Corporation, Insurance & Mobility Solutions (IMS), American International Group Inc., insurethebox, Verisk Analytics Inc., among others. State Farm, Allstate, and Geico, in particular, wield substantial market share, leveraging brand recognition, expansive distribution networks, and a diverse range of products. Their strategies are centered around:

Cost Optimization: Harnessing economies of scale to provide competitive premiums, often achieved through automation and data-driven risk assessment.

Strategic Partnerships: Collaborating with automakers and dealerships to secure a captive audience and cross-sell products.

Investing in Technology: Developing cutting-edge AI-powered claims processing, telematics-based usage-based insurance, and personalized customer experiences.

Emerging Challengers: Disruptors Redefining the Game

Digital-native InsurTech startups like Lemonade and Root Insurance are challenging the traditional norms with their agility and technology-first approach. Noteworthy strategies include:

Direct-to-Consumer Models: Bypassing traditional agents and opting for user-friendly apps and data analysis for underwriting and claims.

Hyper-Personalized Offerings: Utilizing telematics data and other factors to craft nuanced, risk-adjusted premiums tailored to individual drivers.

Innovative Product Lines: Introducing niche insurance products for new mobility models such as electric vehicles and ride-sharing.

Factors Influencing Market Share Analysis

A comprehensive evaluation of the competitive landscape necessitates considering factors beyond mere market share. Key aspects include:

Customer Acquisition Costs: Assessing the efficiency of players in attracting new customers and the associated costs.

Customer Retention Rates: Evaluating how well insurers maintain customer loyalty, influencing renewal rates and overall profitability.

Brand Trust and Reputation: Analyzing how effectively players navigate claims processes, maintain transparency, and build enduring relationships.

Profitability and Growth Potential: Examining the financial health of players and their capacity to invest in future innovations and market expansion.

New and Emerging Trends: Adapting to the Road Ahead

Several trends are reshaping the competitive landscape, including:

Connected Cars and Telematics: Real-time driving data creating new risk assessment models and personalized insurance options.

Autonomous Vehicles: The challenges and opportunities presented by insuring self-driving cars, with companies positioning themselves in this emerging market.

Cybersecurity Threats: The escalating reliance on digital platforms necessitates robust cybersecurity measures, intensifying competition in this domain.

Focus on Sustainability: Insurers exploring environmentally friendly alternatives like usage-based insurance for electric vehicles and incentives for eco-friendly driving habits.

The Overall Competitive Scenario: A Dynamic Intersection

The automotive insurance market is a dynamic tapestry interwoven with established behemoths, nimble disruptors, and an ever-evolving technological landscape. Success hinges on adeptly navigating the twists of personalization, technological integration, and evolving risk profiles. Those who seamlessly steer through these challenges will emerge as leaders in this competitive race.

Industry Developments and Latest Updates

As the industry evolves, key players are adapting and innovating:

AXA SA Group: Forging a partnership with Google Cloud to develop an AI-powered claims platform for faster processing and fraud detection (Source: AXA press release, October 26, 2023).

GEICO: Launching a new telematics-based Usage-Based Insurance (UBI) program with discounts for safe driving habits (Source: GEICO website, December 1, 2023).

Liberty Mutual Insurance: Investing in insurtech startup Root, specializing in UBI for young drivers (Source: TechCrunch, September 20, 2023).

Bajaj Allianz: Introducing a pay-per-kilometer car insurance policy in India, targeting low-mileage drivers (Source: Economic Times, October 11, 2023).

Allstate Insurance Company: Partnering with Tesla to offer discounted insurance rates for Tesla owners with good driving records (Source: Allstate press release, August 3, 2023).

Conclusion

In conclusion, the automotive insurance sector is a dynamic arena where established players and emerging disruptors navigate the competitive landscape. To thrive in this ever-evolving industry, participants must embrace innovation, build robust customer relationships, and adapt to the shifting trends that define the road ahead. The successful integration of technology, sustainability, and personalized offerings will determine the winners in this fast-paced race for dominance.