Regulatory Compliance

The Global Automotive Horn Systems Market Industry is significantly influenced by stringent regulatory requirements regarding vehicle safety. Governments worldwide mandate the installation of effective horn systems to ensure that vehicles can alert pedestrians and other road users. Compliance with these regulations drives manufacturers to innovate and enhance their horn systems. As safety standards evolve, the demand for high-quality, reliable horn systems is expected to rise. This regulatory landscape not only shapes product development but also contributes to the overall market growth, reinforcing the importance of adhering to safety protocols.

Electric Vehicle Adoption

The rise of electric vehicles (EVs) presents a unique opportunity for the Global Automotive Horn Systems Market Industry. As the automotive landscape shifts towards electrification, the demand for specialized horn systems that cater to EVs is likely to increase. These vehicles often require quieter operation, leading to innovations in horn technology that align with environmental standards. The anticipated growth in the EV segment may drive the overall market, contributing to the projected CAGR of 8.99% from 2025 to 2035. This transition not only reflects changing consumer preferences but also emphasizes the need for adaptable horn systems.

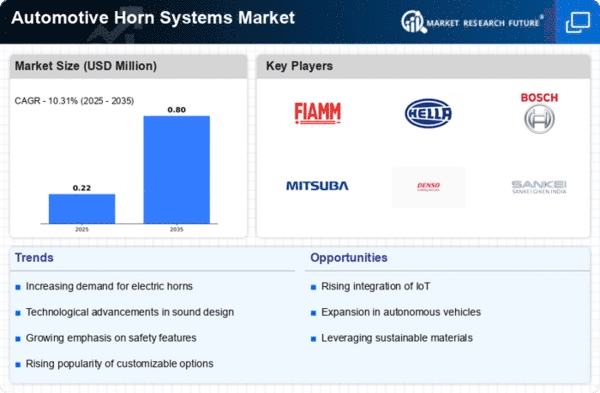

Market Growth Projections

The Global Automotive Horn Systems Market Industry is poised for substantial growth, with projections indicating a market value of 2030.9 USD Million by 2035. This growth is underpinned by various factors, including rising vehicle production, technological advancements, and evolving consumer preferences. The anticipated compound annual growth rate of 8.99% from 2025 to 2035 suggests a dynamic market environment, where innovation and compliance with safety regulations will play crucial roles. As the automotive industry continues to evolve, the horn systems market is likely to adapt, reflecting broader trends in vehicle design and functionality.

Rising Vehicle Production

The Global Automotive Horn Systems Market Industry experiences growth driven by the increasing production of vehicles worldwide. In 2024, the market is valued at approximately 788.2 USD Million, reflecting the demand for automotive components, including horn systems. As manufacturers ramp up production to meet consumer needs, the integration of advanced horn systems becomes essential for safety and compliance with regulations. This trend is expected to continue, with projections indicating a market value of 2030.9 USD Million by 2035, suggesting a robust growth trajectory fueled by the automotive sector's expansion.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Automotive Horn Systems Market Industry. The introduction of electronic horns and smart systems enhances vehicle safety and communication. These advancements not only improve sound quality but also enable features such as integration with vehicle alerts and navigation systems. As consumers increasingly prioritize safety and connectivity, manufacturers are likely to invest in these technologies. The anticipated compound annual growth rate of 8.99% from 2025 to 2035 indicates a strong market response to these innovations, positioning the industry for sustained growth.

Consumer Preferences for Safety Features

Consumer preferences increasingly lean towards vehicles equipped with advanced safety features, thereby impacting the Global Automotive Horn Systems Market Industry. As awareness of road safety rises, consumers are more inclined to choose vehicles that offer superior horn systems capable of providing clear alerts. This shift in consumer behavior encourages manufacturers to prioritize the development of high-performance horn systems. The market's growth trajectory, projected to reach 2030.9 USD Million by 2035, reflects this changing landscape, where safety features are becoming a key differentiator in vehicle purchasing decisions.