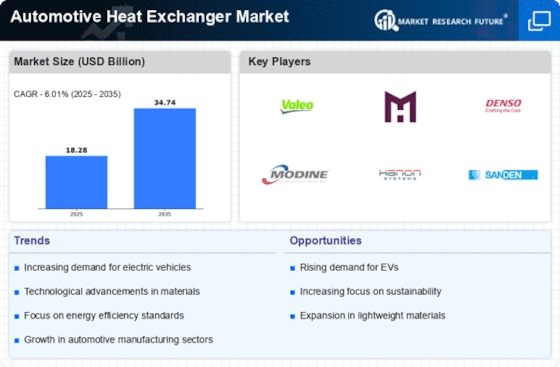

Growth in Electric Vehicle Adoption

The Automotive Heat Exchanger Market is poised for growth due to the increasing adoption of electric vehicles (EVs). As the automotive landscape shifts towards electrification, the need for efficient thermal management systems becomes paramount. Electric vehicles generate significant heat during operation, necessitating advanced heat exchangers to maintain optimal battery and motor temperatures. Market data indicates that the EV segment is expected to account for over 30% of total vehicle sales by 2030, further propelling the demand for specialized heat exchangers. This shift not only enhances vehicle performance but also aligns with sustainability goals, making it a critical driver for the Automotive Heat Exchanger Market.

Increasing Demand for Fuel Efficiency

The Automotive Heat Exchanger Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, manufacturers are compelled to enhance the thermal management systems in their vehicles. Heat exchangers play a pivotal role in optimizing engine performance and reducing fuel consumption. According to recent data, vehicles equipped with advanced heat exchangers can achieve up to 15% better fuel efficiency compared to traditional systems. This trend is likely to drive innovation and investment in the Automotive Heat Exchanger Market, as companies strive to meet regulatory standards and consumer expectations for lower emissions and improved fuel economy.

Regulatory Compliance and Emission Standards

The Automotive Heat Exchanger Market is significantly influenced by stringent regulatory compliance and emission standards imposed by governments worldwide. These regulations aim to reduce greenhouse gas emissions and promote cleaner technologies. As a result, automotive manufacturers are increasingly investing in advanced heat exchanger technologies to meet these requirements. For instance, the implementation of Euro 6 and similar standards has led to a rise in the adoption of high-efficiency heat exchangers, which can reduce emissions by up to 20%. This regulatory landscape is likely to continue shaping the Automotive Heat Exchanger Market, driving innovation and the development of more efficient thermal management solutions.

Rising Consumer Awareness of Vehicle Performance

The Automotive Heat Exchanger Market is also driven by rising consumer awareness regarding vehicle performance and maintenance. As consumers become more informed about the impact of thermal management on vehicle longevity and efficiency, they are increasingly seeking vehicles equipped with advanced heat exchangers. This trend is reflected in market data, which suggests that consumers are willing to pay a premium for vehicles that offer superior thermal management capabilities. Consequently, automotive manufacturers are prioritizing the integration of high-performance heat exchangers in their designs to meet consumer expectations. This growing demand for enhanced vehicle performance is likely to propel the Automotive Heat Exchanger Market forward.

Technological Innovations in Heat Exchanger Design

The Automotive Heat Exchanger Market is witnessing a wave of technological innovations that enhance the efficiency and performance of heat exchangers. Advances in materials science, such as the use of lightweight composites and enhanced surface coatings, are enabling the production of more efficient and durable heat exchangers. Additionally, the integration of smart technologies, such as sensors and IoT capabilities, allows for real-time monitoring and optimization of thermal management systems. These innovations not only improve vehicle performance but also contribute to overall energy savings. As manufacturers continue to invest in research and development, the Automotive Heat Exchanger Market is likely to benefit from these advancements, leading to more competitive products.