Growing Electric Vehicle Adoption

The growing adoption of electric vehicles (EVs) is emerging as a significant driver for the Automotive Head-up Display (HUD) Market. As the automotive landscape shifts towards electrification, manufacturers are increasingly incorporating HUDs into their EV models to enhance user experience and provide essential information about battery status, range, and charging locations. This trend is particularly relevant as consumers seek more intuitive interfaces that align with the advanced technology of electric vehicles. Market data indicates that the EV segment is expected to account for a substantial share of the automotive market in the coming years, further propelling the demand for HUDs. Consequently, the Automotive Head-up Display (HUD) Market is likely to see a robust increase in applications within the electric vehicle sector, reflecting the broader transition towards sustainable mobility.

Rising Demand for Advanced Safety Features

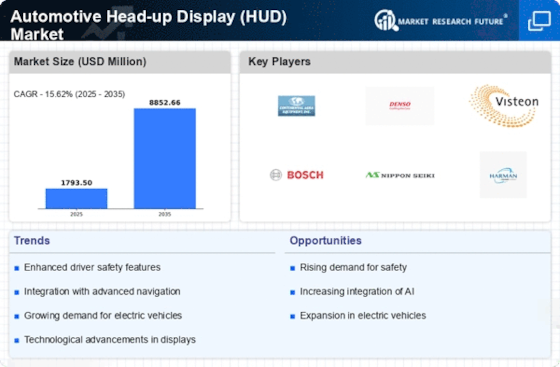

The Automotive Head-up Display (HUD) Market is experiencing a notable surge in demand for advanced safety features. As consumers become increasingly aware of road safety, automakers are integrating HUDs to provide critical information directly in the driver's line of sight. This technology minimizes distractions by allowing drivers to access navigation, speed, and other vital data without taking their eyes off the road. According to recent data, the market for automotive HUDs is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is driven by the increasing adoption of driver assistance systems, which are becoming standard in new vehicle models. Consequently, the Automotive Head-up Display (HUD) Market is poised for significant expansion as manufacturers prioritize safety and convenience.

Consumer Preference for Enhanced Connectivity

Consumer preference for enhanced connectivity features is significantly shaping the Automotive Head-up Display (HUD) Market. As vehicles become more connected, drivers are seeking seamless integration of their smartphones and other devices with their vehicle systems. HUDs serve as a critical interface for displaying notifications, navigation, and other connected services without diverting attention from the road. This trend is particularly pronounced among younger consumers who prioritize technology and connectivity in their vehicle choices. Market Research Future suggests that the demand for connected car technologies is expected to grow substantially, with HUDs playing a pivotal role in this evolution. As a result, the Automotive Head-up Display (HUD) Market is likely to expand as manufacturers respond to consumer desires for enhanced connectivity and integrated digital experiences.

Technological Advancements in Display Technologies

Technological advancements in display technologies are significantly influencing the Automotive Head-up Display (HUD) Market. Innovations such as OLED and LCD technologies are enhancing the clarity and brightness of HUDs, making them more effective in various lighting conditions. These advancements allow for the integration of more complex graphics and real-time data, which can improve the overall driving experience. Furthermore, the introduction of augmented reality features in HUDs is expected to revolutionize how information is presented to drivers. As these technologies continue to evolve, the market is likely to see an increase in consumer interest and adoption rates. The Automotive Head-up Display (HUD) Market is thus positioned to benefit from these technological improvements, which may lead to a broader acceptance of HUDs in both luxury and mainstream vehicles.

Regulatory Push for Enhanced Driver Information Systems

Regulatory bodies are increasingly advocating for enhanced driver information systems, which is positively impacting the Automotive Head-up Display (HUD) Market. Governments are recognizing the importance of reducing road accidents and improving driver awareness, leading to mandates for advanced safety technologies in vehicles. This regulatory push is encouraging automakers to adopt HUDs as a means to comply with safety standards while also enhancing the driving experience. As regulations evolve, the integration of HUDs is likely to become a standard feature in new vehicles, further driving market growth. The Automotive Head-up Display (HUD) Market is thus positioned to benefit from these regulatory changes, which may lead to increased investments in HUD technology and innovation.