Rising Vehicle Production

The Automotive Grease Market is experiencing a surge in demand due to the increasing production of vehicles worldwide. As manufacturers ramp up their output to meet consumer demand, the need for high-quality automotive grease becomes paramount. In 2025, the production of light vehicles is projected to reach approximately 90 million units, which directly correlates with the rising consumption of automotive grease. This trend is further supported by the growing automotive sector in emerging economies, where vehicle ownership is on the rise. Consequently, the Automotive Grease Market is likely to benefit from this upward trajectory in vehicle production, as manufacturers seek to enhance the performance and longevity of their products through superior lubrication solutions.

Growth of Electric Vehicles

The Automotive Grease Market is undergoing a transformation due to the rise of electric vehicles (EVs). While EVs have fewer moving parts compared to traditional internal combustion engine vehicles, they still require specialized lubricants for components such as electric motors and bearings. The EV market is projected to grow at a compound annual growth rate of over 20% through 2025, indicating a substantial shift in automotive technology. This growth presents both challenges and opportunities for the Automotive Grease Market, as manufacturers must adapt their product lines to cater to the unique lubrication needs of electric vehicles. Consequently, the industry may see an increase in the development of innovative greases specifically designed for EV applications, potentially reshaping the market landscape.

Regulatory Compliance and Standards

The Automotive Grease Market is significantly influenced by stringent regulatory standards aimed at reducing environmental impact and ensuring product safety. Governments worldwide are implementing regulations that require automotive lubricants to meet specific performance and environmental criteria. For instance, regulations concerning the use of hazardous substances in lubricants are becoming more prevalent, prompting manufacturers to develop compliant products. This shift towards regulatory compliance is likely to drive innovation within the Automotive Grease Market, as companies invest in research and development to create environmentally friendly and high-performance greases. As a result, the market may witness a transformation in product offerings, aligning with both regulatory requirements and consumer expectations.

Increased Focus on Vehicle Maintenance

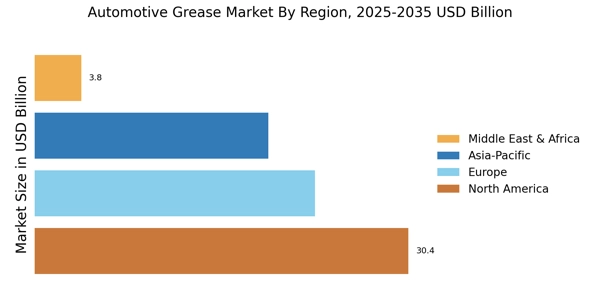

The Automotive Grease Market is benefiting from a heightened awareness of vehicle maintenance among consumers. As vehicles become more complex, regular maintenance has become essential to ensure optimal performance and longevity. This trend is reflected in the growing aftermarket segment, where consumers are increasingly investing in quality lubricants and greases. In 2025, the aftermarket for automotive lubricants is projected to reach approximately 30 billion dollars, underscoring the importance of maintenance in the automotive sector. This focus on maintenance not only drives demand for automotive grease but also encourages manufacturers to innovate and improve their product offerings, thereby enhancing the overall quality and performance of lubricants in the Automotive Grease Market.

Technological Innovations in Lubricants

Technological advancements in lubricant formulations are significantly influencing the Automotive Grease Market. Innovations such as synthetic greases and bio-based lubricants are gaining traction, offering enhanced performance characteristics compared to traditional options. For instance, synthetic greases provide superior thermal stability and resistance to oxidation, which are critical for modern automotive applications. The market for synthetic lubricants is expected to grow at a compound annual growth rate of around 5% through 2025, indicating a shift towards more advanced lubrication solutions. As automotive manufacturers increasingly prioritize efficiency and sustainability, the Automotive Grease Market is poised to evolve in response to these technological trends, potentially leading to the development of new products that meet stringent performance standards.