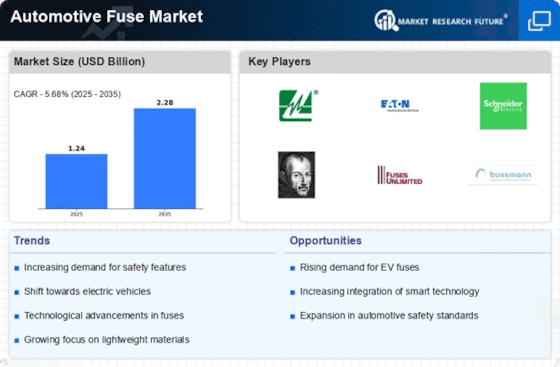

Top Industry Leaders in the Automotive Fuse Market

Navigating the Intricacies of the Automotive Fuse Market Unraveling the Pulsating Landscape

In the realm of automotive fuses, a battleground of intense competition unfolds. Major contenders engage in a strategic dance for dominance, employing multifaceted tactics and adapting to the ever-evolving trends. Let's embark on an exploration of the current panorama, dissecting the maneuvers of key players, influencers shaping market dominance, and the emergence of trends that set the pulse racing:

Key Players and Their Stratagems:

- Eaton (Ireland)

- ON Semiconductor (US)

- Littelfuse Inc. (US)

- Sensata Technologies Inc. (US)

- MERSEN S.A. (France)

- SCHURTER Holding AG (Switzerland)

- OptiFuse (U.S.)

- Panduit Corp (U.S.)

- AEM Inc. (U.S.)

- Blue Sea Systems(U.S.) among others

-

Littelfuse: Ascending as a formidable force, accentuating technological ingenuity and diversification of product offerings. Recent strides include the 2023 acquisition of Cole Hersee, fortifying their grip on heavy-duty vehicle fuses. (Source: Littelfuse press release, June 2023) -

TE Connectivity: Channeling efforts into miniaturization and high-performance solutions, tailored to meet the burgeoning demand for compact, sophisticated electronics in contemporary vehicles. The unveiling of the BUX Fuse Block for EV batteries in October 2023 vividly exemplifies this strategic focus. (Source: TE Connectivity website, October 2023) -

Cooper Bussmann: Advocating for cost-effectiveness and reliability, setting sights on mid-segment and budget-conscious automobile manufacturers. A noteworthy alliance with Xinyi Hi-Tech in China, declared in May 2023, epitomizes their committed pursuit. (Source: Cooper Bussmann press release, May 2023) -

Bussmann: Pours resources into research and development, spearheading innovations such as self-resetting fuses and intelligent fuses incorporating integrated sensors. A recent collaboration with the University of Michigan on next-generation fuse technology magnifies their commitment to pioneering advancements. (Source: Bussmann website, August 2023) -

Yazaki: Revered for a robust presence in Asian markets, particularly in Japan. They exploit vertical integration, engaging in the manufacturing of both fuses and wiring harnesses, endowing them with a distinct cost advantage. (Source: Yazaki annual report 2022)

Factors Steering Market Dominance Analysis:

-

Product Portfolio: The expanse and intricacy of offerings tailored to diverse vehicle segments and electrical exigencies wield considerable influence. Littelfuse shines with an all-encompassing range, while specialized players like Bussmann distinguish themselves with cutting-edge technological solutions. -

Geographic Span: Establishment in pivotal automotive manufacturing regions like North America, Europe, and Asia assumes paramount importance. The ascendancy of Yazaki in Asia and TE Connectivity's expansive global network eloquently underscore the significance of this aspect. -

Brand Esteem: The imprimatur of a trusted brand conveys reliability and quality, swaying the choices of automotive manufacturers. Littelfuse's enduring reputation and Cooper Bussmann's laser focus on safety-critical applications vividly exemplify this influential factor. -

Cost Viability: Striking a delicate balance between affordability and quality assumes critical importance, especially in cost-sensitive sectors. The strategic partnerships of Cooper Bussmann and the vertical integration prowess of Yazaki serve as prime examples of this judicious approach. -

Technological Ingenuity: The infusion of resources into research and development to birth cutting-edge solutions like self-resetting fuses and intelligent fuses with integrated sensors can yield a competitive edge. Bussmann and TE Connectivity emerge as luminaries in this particular facet.

Emerging Trends and Corporate Responses:

-

Electrification: The surge of electric vehicles (EVs) ushers in a paradigm shift, laden with both challenges and opportunities. Conventional blade fuses may find themselves ill-suited for high-voltage EV systems, necessitating the inception of new designs like high-voltage fuses and busbar protection systems. TE Connectivity's BUX Fuse Block for EV batteries and Littelfuse's acquisition of Cole Hersee, with its proficiency in heavy-duty electric vehicles, aptly illustrate companies aligning with this transformative trend. -

Advanced Driver-Assistance Systems (ADAS): The burgeoning embrace of ADAS features, encompassing automated parking and lane departure warning, amplifies the array of electronic components in need of safeguarding, fueling demand for specialized fuses. Littelfuse's recent introduction of the MicroMAX fuses serves as a tangible manifestation of this upward trend. -

Connectivity and IoT: The fusion of connected car technologies mandates robust electrical protection solutions for intricate communication systems. TE Connectivity's emphasis on miniaturization and high-performance solutions strategically positions them at the forefront of this domain.

Holistic Competitive Scenario:

Key contenders deploy a mosaic of strategies, ranging from technological prowess to expansive geographical forays and judicious cost competitiveness. While entrenched players wield substantial market clout, nimble specialists and enterprising newcomers armed with innovative solutions hold the potential to disrupt the equilibrium. Triumph hinges on adaptability, strategic alliances, and an astute grasp of nascent trends.