Market Share

Automotive Fuel Injection Pump Market Share Analysis

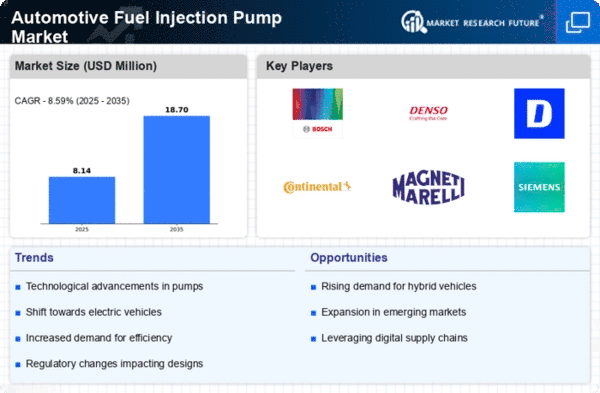

The automotive fuel injection pump market has undergone significant changes, driven by various trends shaping the automotive industry. One major trend in this market is the shift towards advanced fuel injection systems. As vehicles evolve to meet stricter emissions regulations and improve fuel efficiency, there's a growing demand for sophisticated fuel injection pumps. Manufacturers are developing high-pressure direct injection systems that deliver precise amounts of fuel into the engine cylinders, enhancing combustion efficiency and reducing emissions. These advanced systems also contribute to improved engine performance and power output, aligning with the industry's pursuit of cleaner and more efficient propulsion technologies.

Moreover, the increasing adoption of electric and hybrid vehicles has impacted the automotive fuel injection pump market. While these vehicles operate on electric power, hybrid models often incorporate internal combustion engines that require fuel injection systems. However, the design and requirements for fuel injection pumps in hybrids and electric vehicles differ from those in traditional internal combustion engine vehicles. Manufacturers are developing specialized fuel injection systems tailored to the needs of hybrid powertrains, focusing on optimizing fuel usage and emissions while ensuring compatibility with electric vehicle components.

Additionally, the industry's emphasis on lightweight materials and components has influenced the automotive fuel injection pump market. Manufacturers are exploring innovative materials and manufacturing techniques to produce lightweight yet durable fuel injection pumps. Lightweight components contribute to overall vehicle weight reduction, enhancing fuel efficiency and performance. Materials like aluminum alloys and advanced plastics are being increasingly utilized in the construction of fuel injection pumps to meet these demands for lighter and more efficient automotive systems.

Furthermore, the integration of electronic controls and smart technologies is a prominent trend in the automotive fuel injection pump market. Modern fuel injection systems are becoming more sophisticated, incorporating electronic controls and sensors to precisely manage fuel delivery based on engine demands and driving conditions. These intelligent systems continuously adjust fuel injection timing and volume, optimizing engine performance and efficiency. Additionally, the connectivity of these systems to onboard vehicle networks allows for real-time monitoring and diagnostics, enabling proactive maintenance and enhancing overall reliability.

Moreover, the global push towards alternative fuels and renewable energy sources is impacting the automotive fuel injection pump market. The rise of biofuels, such as ethanol and biodiesel, requires compatible fuel injection systems capable of handling these alternative fuels. Manufacturers are developing fuel injection pumps that can accommodate a broader range of fuel types, ensuring compatibility with diverse fuel sources. This trend aligns with efforts to reduce reliance on fossil fuels and transition towards more sustainable and environmentally friendly fuel options.

The automotive fuel injection pump market is witnessing significant transformations driven by advancements in technology, regulatory changes, and evolving consumer preferences. The demand for more efficient, environmentally friendly, and adaptable fuel injection systems continues to shape the industry. As automotive manufacturers strive to meet stringent emissions standards, enhance vehicle performance, and accommodate the shift towards electric and hybrid vehicles, the market for innovative fuel injection pump solutions is poised for further development and innovation in the years ahead.

Leave a Comment