Growing Environmental Concerns

The Automotive Fuel Cell Market is significantly influenced by growing environmental concerns among consumers and policymakers. As awareness of climate change and air pollution increases, there is a rising demand for cleaner transportation alternatives. Fuel cell vehicles, which emit only water vapor, are viewed as a viable solution to reduce greenhouse gas emissions. Recent surveys indicate that over 60% of consumers are willing to consider fuel cell vehicles as a sustainable option. Additionally, regulatory pressures to meet stringent emissions targets are prompting automotive manufacturers to invest in fuel cell technology. The shift towards sustainability is not merely a trend; it is becoming a fundamental aspect of automotive strategy. Consequently, the Automotive Fuel Cell Market is likely to benefit from this heightened focus on environmental responsibility, driving innovation and adoption in the coming years.

Government Initiatives and Support

Government initiatives play a crucial role in shaping the Automotive Fuel Cell Market. Various countries are implementing policies and providing financial incentives to promote the adoption of fuel cell vehicles. For example, subsidies for hydrogen infrastructure development and tax incentives for consumers purchasing fuel cell vehicles are becoming increasingly common. In recent years, investments in hydrogen refueling stations have surged, with projections indicating a growth rate of over 20% annually. Such initiatives are designed to reduce greenhouse gas emissions and promote cleaner transportation solutions. Additionally, international agreements aimed at reducing carbon footprints are likely to further encourage governments to support the fuel cell sector. This supportive regulatory environment is expected to catalyze growth in the Automotive Fuel Cell Market, making it a focal point for future automotive innovations.

Technological Advancements in Fuel Cells

The Automotive Fuel Cell Market is experiencing a surge in technological advancements that enhance fuel cell efficiency and reduce costs. Innovations in membrane technology, catalyst development, and fuel cell stack design are pivotal. For instance, the introduction of high-temperature fuel cells has improved performance and durability, making them more appealing for automotive applications. According to recent data, the efficiency of fuel cells has increased by approximately 30% over the past five years, which is likely to drive adoption rates. Furthermore, advancements in hydrogen production methods, such as electrolysis and reforming, are expected to lower the overall cost of hydrogen fuel, thereby making fuel cell vehicles more economically viable. These technological strides not only bolster the Automotive Fuel Cell Market but also contribute to a more sustainable automotive ecosystem.

Increased Collaboration Across Industries

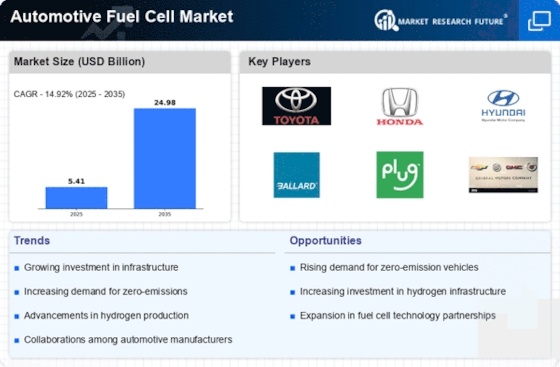

The Automotive Fuel Cell Market is witnessing a notable increase in collaboration across various sectors, including automotive, energy, and technology. Partnerships between automotive manufacturers and energy companies are becoming more prevalent, as stakeholders recognize the potential of hydrogen as a clean energy source. For instance, joint ventures aimed at developing hydrogen infrastructure and fuel cell technology are on the rise. Recent collaborations have led to the establishment of several pilot projects that demonstrate the feasibility of fuel cell vehicles in real-world scenarios. This collaborative approach not only accelerates technological advancements but also enhances market acceptance. Furthermore, the integration of fuel cells with renewable energy sources, such as solar and wind, is likely to create synergies that benefit the Automotive Fuel Cell Market. Such partnerships are essential for overcoming the challenges associated with hydrogen production and distribution.

Rising Demand for Alternative Fuel Vehicles

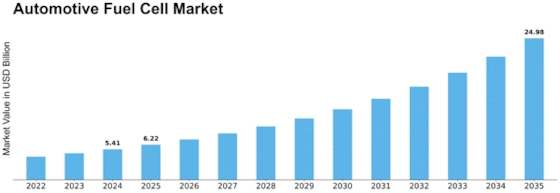

The Automotive Fuel Cell Market is experiencing a rising demand for alternative fuel vehicles, driven by shifting consumer preferences and regulatory frameworks. As traditional fossil fuel sources face scrutiny, consumers are increasingly seeking sustainable transportation options. Fuel cell vehicles, which offer longer ranges and quicker refueling times compared to battery electric vehicles, are gaining traction. Market data suggests that sales of fuel cell vehicles are projected to grow at a compound annual growth rate of over 15% in the next five years. This trend is further supported by the expansion of hydrogen refueling infrastructure, which is essential for consumer confidence. As more automakers enter the fuel cell market, competition is likely to foster innovation and lower costs, thereby enhancing the appeal of fuel cell vehicles. The Automotive Fuel Cell Market stands to benefit from this growing demand, positioning itself as a key player in the future of transportation.

Leave a Comment