Top Industry Leaders in the Automotive Fuel Cell Market

*Disclaimer: List of key companies in no particular order

Dynamics Shaping Growth in the Automotive Fuel Cell Market: An In-Depth Exploration of the Competitive Landscape

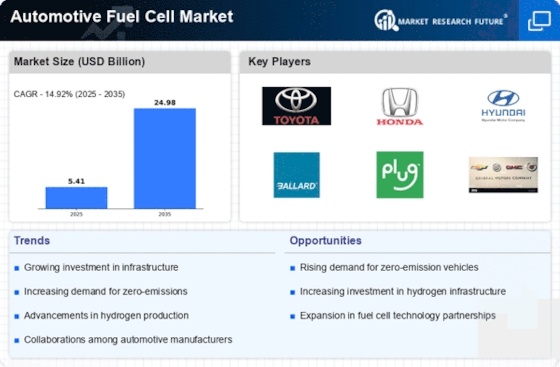

The Automotive Fuel Cell Market is poised for significant growth, propelled by escalating environmental concerns, stringent emission regulations, and advancements in hydrogen infrastructure. This dynamic landscape is marked by key players employing diverse strategies to secure market share and adapt to evolving industry dynamics. This comprehensive analysis delves into player strategies, market share determinants, emerging trends, and the overall scenario within the competitive landscape.

Key Player Strategies:

Established Automakers:

- Industry giants, including Toyota, Hyundai, Honda, and GM, leverage their production capabilities, distribution networks, and brand recognition for an early foothold.

- Toyota, a pioneer in the field, leads with its Mirai fuel cell car, while Hyundai caters to diverse customer segments with its Nexo SUV.

- Collaboration with governments and energy companies is a common strategy to establish hydrogen refueling infrastructure, creating a comprehensive ecosystem.

Fuel Cell Technology Developers:

- Companies like Ballard Power Systems, Johnson Matthey, and Bloom Energy focus on innovating and optimizing fuel cell technology.

- Ballard, a leader in proton exchange membrane (PEM) fuel cells, provides power systems for various vehicles and applications.

- Johnson Matthey specializes in catalyst development, enhancing fuel cell efficiency and performance.

Hydrogen Suppliers and Infrastructure Players:

- Air Liquide, Linde, and Shell invest significantly in hydrogen production and refueling station networks.

- Air Liquide boasts the largest hydrogen fueling station network in Europe, while Shell collaborates with Toyota to establish stations in California.

Startups and Disruptors:

- New entrants like Nikola Motor Company and Hyzon Motors bring fresh perspectives and agility to the market.

- Nikola focuses on heavy-duty trucks, while Hyzon offers fuel cell buses and trucks, targeting specific segments with tailored solutions.

Factors for Market Share Analysis:

-

Technology Portfolio: Companies with a broad range of fuel cell offerings across various vehicle segments and applications hold a competitive advantage.

-

Production Capacity and Cost Efficiency: Players with efficient manufacturing capabilities and cost-competitive fuel cell systems are well-positioned to capture market share.

-

Collaboration and Partnerships: Strategic alliances with automakers, energy companies, and governments significantly accelerate growth and infrastructure development.

-

Brand Recognition and Customer Service: Established automakers leverage their reputation and customer base, building trust through reliable after-sales service.

-

Government Incentives and Regulations: Supportive government policies, such as subsidies, tax breaks, and stringent emission regulations, incentivize fuel cell vehicle adoption.

New and Emerging Trends:

Diversification of Vehicle Segments:

- Focus is expanding beyond passenger cars to heavier vehicles like trucks and buses, offering higher fuel efficiency and range benefits.

Solid-State Fuel Cells:

- Next-generation technology promises higher energy density, faster refueling, and improved durability, potentially disrupting the market.

Hydrogen Production and Utilization:

- Advancements in renewable hydrogen production methods, such as electrolysis, are lowering costs and creating a sustainable ecosystem.

Integration with Autonomous Driving:

- Fuel cell technology's compatibility with electric motors makes it ideal for autonomous vehicles, creating synergy for future mobility solutions.

Overall Competitive Scenario:

Collaboration and partnerships will be pivotal for overcoming infrastructure challenges and driving widespread adoption. As the market matures, cost reduction, technological advancements, and government support will be key differentiators for success. Companies are engaged in a race to establish dominance, promising to revolutionize the future of clean transportation.

Industry Developments and Latest Updates:

Ballard Power Systems Inc. (Canada):

- Dec 22, 2023: Announced a collaboration with Adani Green Hydrogen to develop and manufacture fuel cell stacks in India.

ITM Power (U.K.):

- Oct 26, 2023: Opened a new £45 million manufacturing facility in Sheffield, UK.

Hydrogenics (Canada):

- Dec 19, 2023: Announced a partnership with Ballard Power Systems and Westport to develop fuel cell powertrains for heavy-duty trucks.

Plug Power Inc. (U.S.):

- Nov 03, 2023: Signed a multi-year agreement with Amazon to supply hydrogen fuel cells for its forklifts and warehouse operations.

Ceramic Fuel Cells Ltd (Australia):

- Announced a A$15 million capital raise in November 2023 to scale up production of solid oxide fuel cells.

Top Companies in the Automotive Fuel Cell Industry include Ballard Power Systems Inc. (Canada), ITM Power (U.K.), Hydrogenics (Canada), Plug Power (U.S.), Automotive Fuel Cell Cooperation (Canada), and Ceramic Fuel Cells Ltd (Australia). Other notable players include Delphi Technologies (U.K.), Doosan Fuel Cell America (U.S.), Nedstack (The Netherlands), and Plug Power (U.S.).