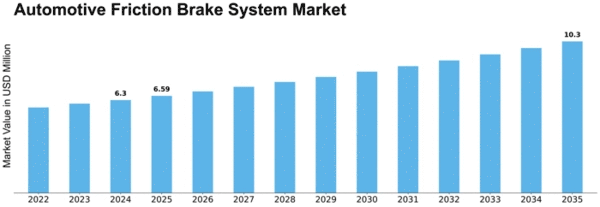

Automotive Friction Brake System Size

Automotive Friction Brake System Market Growth Projections and Opportunities

The automotive friction brake system market is influenced by several key factors that shape its growth and development. One of the primary drivers of this market is the global automotive industry's growth and expansion. As the number of vehicles on the road continues to rise, the demand for reliable and efficient braking systems increases accordingly. This steady growth in vehicle production fuels the demand for friction brake systems, which are essential components for vehicle safety and performance.

Technological advancements in brake system design and materials also play a significant role in driving the automotive friction brake system market. Manufacturers are continually innovating to improve brake performance, durability, and efficiency. Advancements such as anti-lock braking systems (ABS), electronic brake-force distribution (EBD), and regenerative braking systems enhance vehicle safety and fuel efficiency, driving the adoption of advanced friction brake systems.

Regulatory mandates and safety standards are critical market factors shaping the automotive friction brake system market. Governments worldwide impose regulations and standards aimed at enhancing vehicle safety, including requirements for brake performance, durability, and reliability. Compliance with these regulations is essential for automotive manufacturers, driving investments in research and development to meet or exceed regulatory requirements.

Market competition and vendor landscape also influence the trajectory of the automotive friction brake system market. With numerous players operating in the market, competition is intense, leading to innovation, price competition, and strategic partnerships. Established brake system manufacturers, as well as new entrants and startups, compete to differentiate their offerings and capture market share. Strategic collaborations between automotive manufacturers, brake system suppliers, and technology providers drive market growth by leveraging complementary capabilities and resources.

Consumer preferences and market trends also impact the automotive friction brake system market. Safety-conscious consumers prioritize vehicles equipped with advanced braking systems that offer reliable performance and enhanced safety features. Additionally, market trends such as the growing demand for electric vehicles (EVs) and autonomous vehicles (AVs) influence the adoption of friction brake systems. EVs and AVs require specialized braking systems tailored to their unique operating characteristics, driving innovation and market demand for friction brake systems.

Economic conditions and vehicle ownership trends are significant market factors shaping the automotive friction brake system market. Economic factors such as GDP growth, consumer spending, and automotive industry investments impact the pace and scale of brake system sales. Vehicle ownership trends, including fleet sizes, vehicle replacement cycles, and consumer preferences, also influence market demand for friction brake systems.

Global trends such as environmental sustainability and vehicle electrification further drive the demand for automotive friction brake systems. As concerns about climate change and air pollution mount, governments and consumers increasingly prioritize fuel-efficient vehicles with reduced emissions. Friction brake systems play a crucial role in improving vehicle fuel efficiency and reducing emissions by optimizing braking performance and energy recovery.

In conclusion, the automotive friction brake system market is influenced by a combination of factors, including industry growth, technological advancements, regulatory mandates, market competition, consumer preferences, and global trends. As automotive manufacturers strive to meet evolving safety and performance standards while addressing environmental concerns and market demands, the automotive friction brake system market is poised for continued growth and innovation in the years to come.

Leave a Comment