Market Analysis

In-depth Analysis of Automotive Friction Brake System Market Industry Landscape

The automotive friction brake system market is shaped by various factors influencing its growth, competition, and technological advancements. Friction brake systems, which are crucial components in vehicles for decelerating and stopping, play a significant role in ensuring safety and performance on the road. One of the primary drivers of the market is the steady growth of the automotive industry globally. With the increasing production and sales of vehicles, the demand for friction brake systems continues to rise, driven by both original equipment manufacturers (OEMs) and aftermarket sales.

Technological innovations are key drivers influencing the dynamics of the automotive friction brake system market. Manufacturers are constantly developing and introducing advanced brake technologies to enhance performance, durability, and safety. Innovations such as anti-lock braking systems (ABS), electronic stability control (ESC), regenerative braking systems, and brake-by-wire systems are becoming increasingly common in modern vehicles. These technologies not only improve braking efficiency but also contribute to fuel efficiency and vehicle electrification trends.

Furthermore, regulatory standards and safety mandates play a significant role in shaping the market dynamics of automotive friction brake systems. Governments worldwide impose stringent regulations and standards to ensure the safety and performance of braking systems in vehicles. Compliance with these regulations drives research and development efforts among brake system manufacturers to meet or exceed safety requirements while maintaining cost-effectiveness and performance.

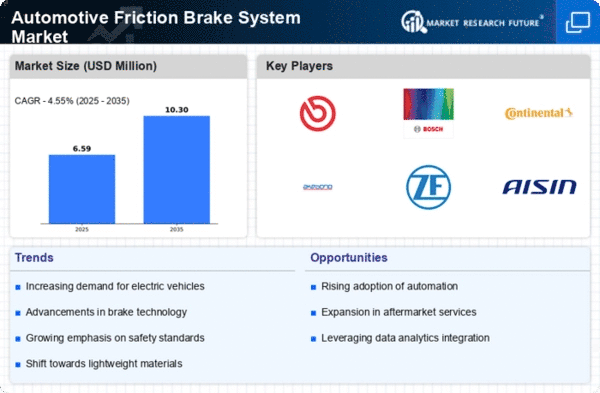

Market competition also significantly influences the dynamics of the automotive friction brake system market. The market is highly competitive, with numerous players including multinational corporations, regional manufacturers, and aftermarket suppliers. Intense competition drives innovation, product differentiation, and pricing strategies among market players. Moreover, mergers, acquisitions, and strategic partnerships are common in the industry as companies seek to expand their product portfolios, enhance their market presence, and capitalize on emerging opportunities.

Consumer preferences and demand for enhanced driving experience and safety features are driving the adoption of advanced friction brake systems. Consumers are increasingly seeking vehicles equipped with advanced braking technologies that offer improved responsiveness, control, and safety features. As a result, OEMs are integrating advanced brake systems as standard or optional features in new vehicle models to meet consumer expectations and gain a competitive edge in the market.

Moreover, environmental concerns and sustainability initiatives are influencing the market dynamics of automotive friction brake systems. With growing awareness of climate change and air pollution, there is a heightened focus on reducing emissions and improving fuel efficiency in vehicles. This has led to the development of regenerative braking systems, which capture and store kinetic energy during braking to power auxiliary systems or recharge batteries in hybrid and electric vehicles. Additionally, the use of lightweight materials and aerodynamic designs in brake system components contributes to vehicle weight reduction and improved fuel economy.

Supply chain dynamics and raw material prices also impact the automotive friction brake system market. Fluctuations in the prices of raw materials such as steel, aluminum, and rubber can affect manufacturing costs and profit margins for brake system manufacturers. Moreover, disruptions in the supply chain, such as natural disasters, geopolitical tensions, or trade disputes, can lead to production delays and supply shortages, impacting market dynamics and availability of brake system components.

In conclusion, the market dynamics of the automotive friction brake system are shaped by a combination of factors including technological innovation, regulatory standards, market competition, consumer preferences, environmental considerations, and supply chain dynamics. As the automotive industry continues to evolve, driven by advancements in vehicle electrification, autonomous driving technologies, and sustainability initiatives, the demand for advanced friction brake systems is expected to grow, creating opportunities for manufacturers to innovate and expand their market presence.

Leave a Comment